Pre-FOMC USD Price Action Setups: EUR/USD, GBP/USD, USD/CAD, USD/JPY

September 15, 2025 21:41US Dollar Talking Points:

- The US Dollar is breaking down ahead of the widely-expected rate cut from the FOMC at tomorrow’s meeting.

- The bigger question is whether the Fed will echo the dovish expectation built in by markets, with as much as 125-150 bps of softening expected into the end of next year. This puts emphasis on the bank’s Summary of Economic Projections, which will also contain forecasts for inflation, growth and employment.

- This is an archived webinar and you’re welcome to join the next one. Click here to register.

Since the global financial collapse the Federal Reserve has largely managed markets with expectations, often communicated by the Summary of Economic Projections but also using media engagements with Fed members to sway capital flows in one direction or the other. This has been incredibly effective, on net, at least if we’re evaluating the matter from the perspective of stock prices.

That’s actually an interesting variable, because that also comes into play here, as it’s the Fed’s embrace of the Wealth Effect, or the ‘implied third mandate,’ that’s on full display at tomorrow’s rate decision. Inflation remains high and unemployment remains low, at least from the perspective of the unemployment rate. When Powell last opined on the matter on July 30th, at the last FOMC meeting, he said that policy didn’t seem overly restrictive given those two factors, which are the two sides of the Fed’s dual mandate.

And from that perspective, really, the Fed should not be cutting, and there’s an argument that rates should be much higher considering that inflation has been going up by most metrics over the past few months.

Yet, not only is the Fed widely-expected to cut, they’re also expected to lean heavy into a dovish cycle that’s pricing in as much as 125-150 bps in cuts to the end of next year. And this really begs the question, what is it that the Fed sees that isn’t quite showing up in the data?

And a related question, with so many cuts already priced-in, how much more bearish can USD bears get, and what can the Fed say that will compel that drive?

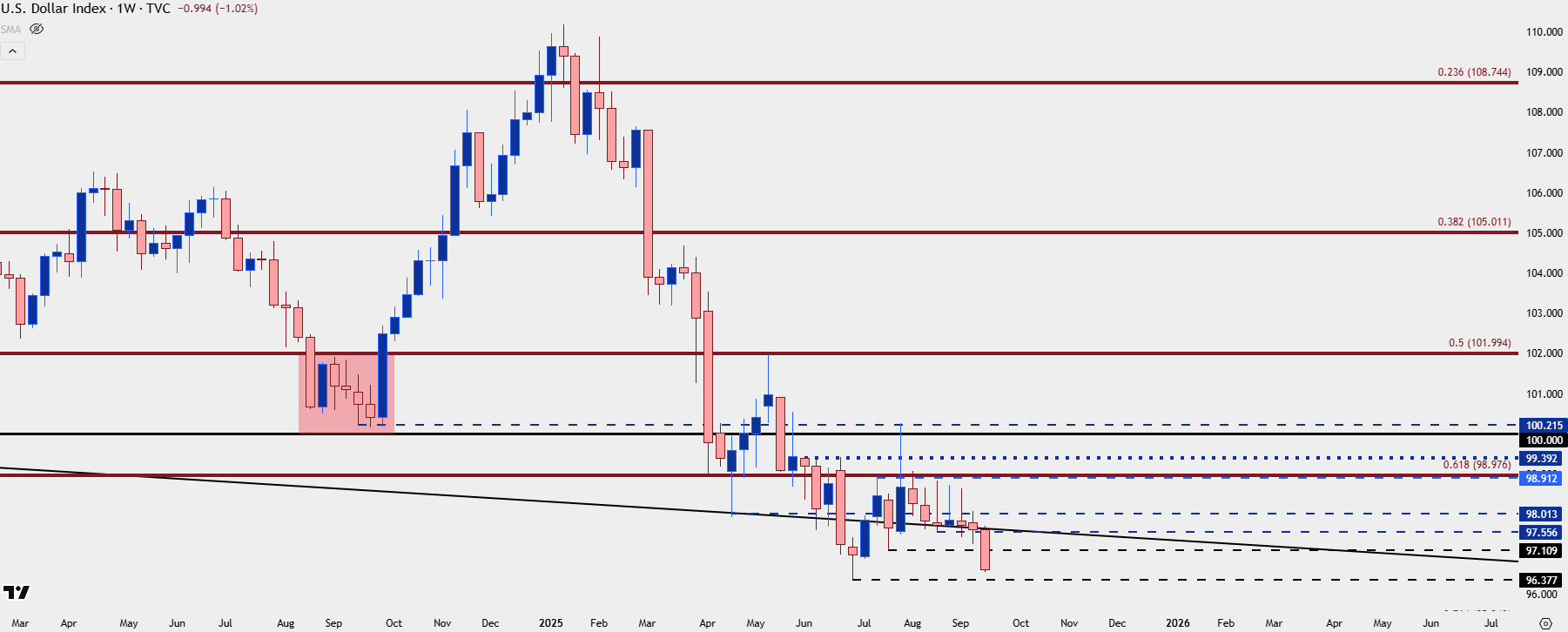

At this point the USD has been selling off to a fresh monthly low although it does remain above the Q3 opening swing-low, as of this writing. As highlighted in the webinar, I think this is a bit of positioning in EUR/USD ahead of the FOMC meeting with EUR/USD shorts getting squeezed as positions square up. Given the shift at the ECB last week, there could be wherewithal for continuation, but it seems that the Fed will essentially need to mirror or beat the market’s current expectation for rate cuts, which will probably require some massaging of the bank’s forecasts for inflation and unemployment.

US Dollar Daily Chart

Chart prepared by James Stanley; data derived from Tradingview

EUR/USD

EUR/USD is breaking out with a push from Christine Lagarde’s comment at the ECB meeting last week, saying that the disinflationary process was over for the Eurozone. I looked at this in the Tuesday webinar, ahead of the event, and then later in the week after that comment.

Going into last week, there was a bullish breakout from both a bull pennant and an inverse head and shoulders pattern. As of this writing, the pair is trading at a fresh four-year-high, and if USD bears are going to get their way, they’re likely going to need some continued participation from EUR/USD.

EUR/USD Four-Hour Chart

Chart prepared by James Stanley; data derived from Tradingview

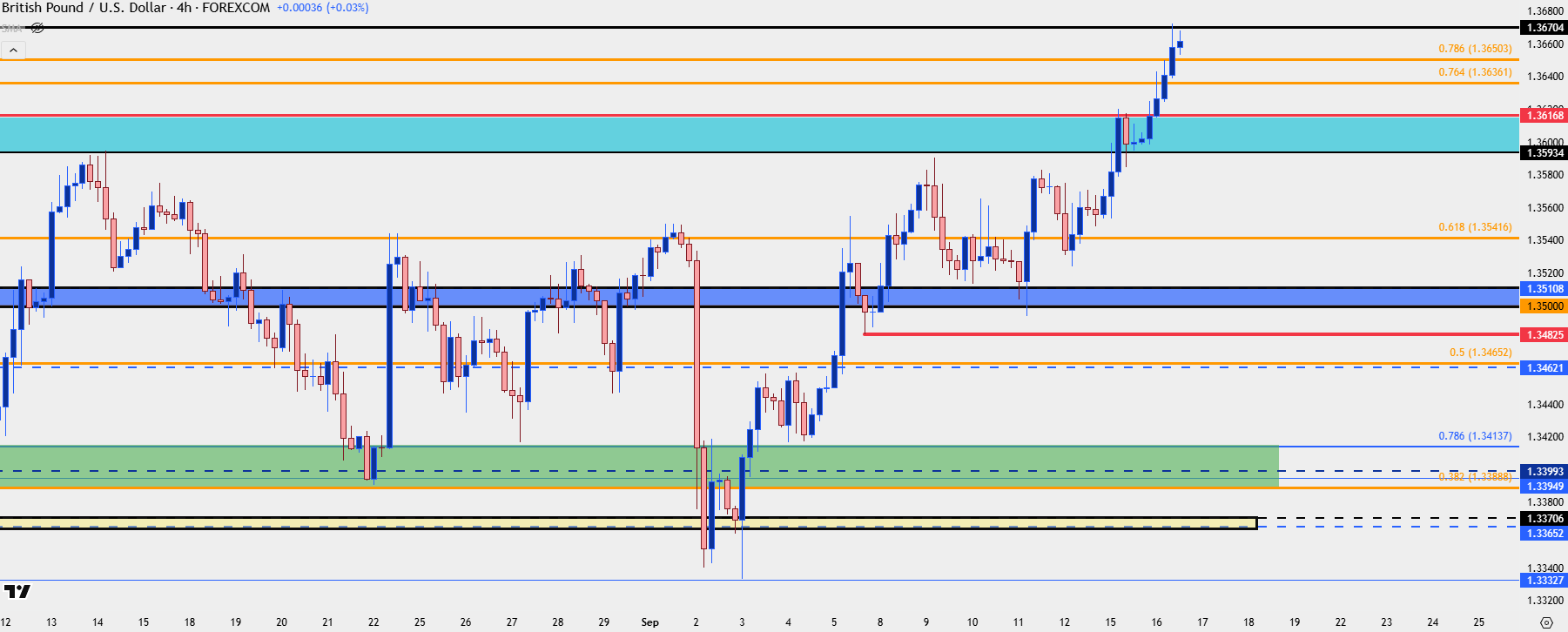

GBP/USD: Clean Cable

The support looked at in last week’s webinar at the 1.3500 handle held cleanly, and this morning saw price move up to resistance at 1.3670. Contrasting with EUR/USD above, the pair is not at a fresh four-year-high, but it still does remain attractive for USD-weakness scenarios.

GBP/USD Four-Hour Chart

Chart prepared by James Stanley; data derived from Tradingview

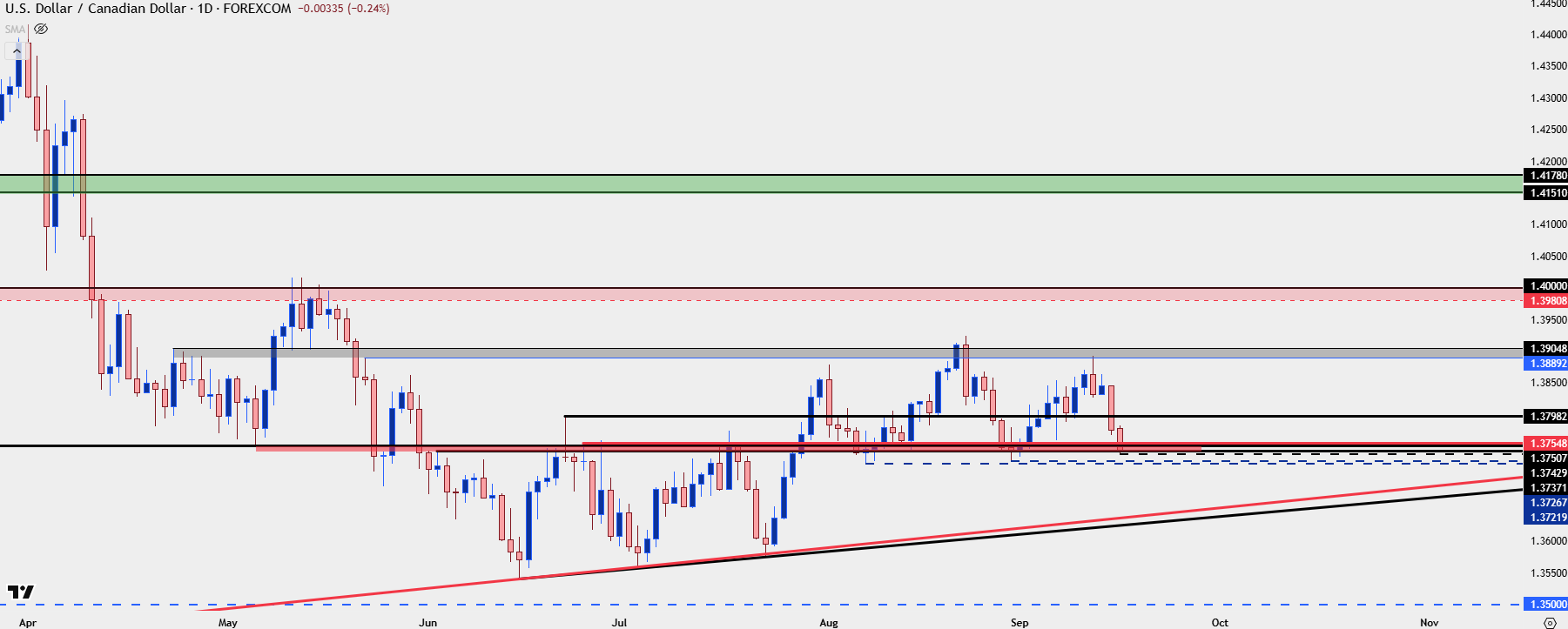

USD/CAD

USD/CAD has pulled back after this morning’s Canadian CPI print, and tomorrow also brings a Bank of Canada rate decision, with the expectation that the BoC could cut rates. That hasn’t stopped CAD-bulls, however, as price has snapped back for re-test of the 1.3750 support level. Into the FOMC meeting, this pair remains attractive for USD-strength scenarios given that hold of higher-low support, at support taken from prior resistance in the 1.3750 region.

USD/CAD Daily Chart

Chart prepared by James Stanley; data derived from Tradingview

USD/JPY

I looked into the Yen yesterday and as shared there, I think the Yen weakness that’s kept USD/JPY range-bound for the past month and change can be sought after elsewhere, such as EUR/JPY or GBP/JPY. If we do get a legitimate breakdown in the USD, to the point where it carries over into USD/JPY, there could, eventually, be de-leveraging concerns as we get back to a carry unwind scenario, similar to what showed up last July.

At this point, however, USD/JPY is clinging to bullish structure that built from the April low, and there’s a spot of support nearing around 145.86.

USD/JPY Daily Chart

Chart prepared by James Stanley; data derived from Tradingview

— written by James Stanley, Senior Strategist