Gold Update: XAU/USD Stalls Around $3,600 per Ounce

September 12, 2025 01:02Over the last three trading sessions, gold has shown a variation of just 0.8%, reflecting that the price has entered a consolidation phase after reaching new record highs above $3,600 per ounce. Buying pressure, which had dominated since late August, has eased following the release of U.S. inflation data and the absence of additional central bank comments. This pause, near record levels, may open the door for selling pressure to emerge in the short term, leading to potential corrections in XAU/USD.

Is Gold Activity Slowing?

Last week was marked by the release of U.S. employment data, while today the annual CPI was reported at 2.9%, exactly in line with forecasts. The result did not materially alter expectations for the Federal Reserve, which is still projecting an interest rate cut at its upcoming September 17 meeting. What stands out, however, is that gold has decided to pause its rally despite these events, likely because much of the macroeconomic news had already been priced in by the market, leaving limited room for further highs in the short term.

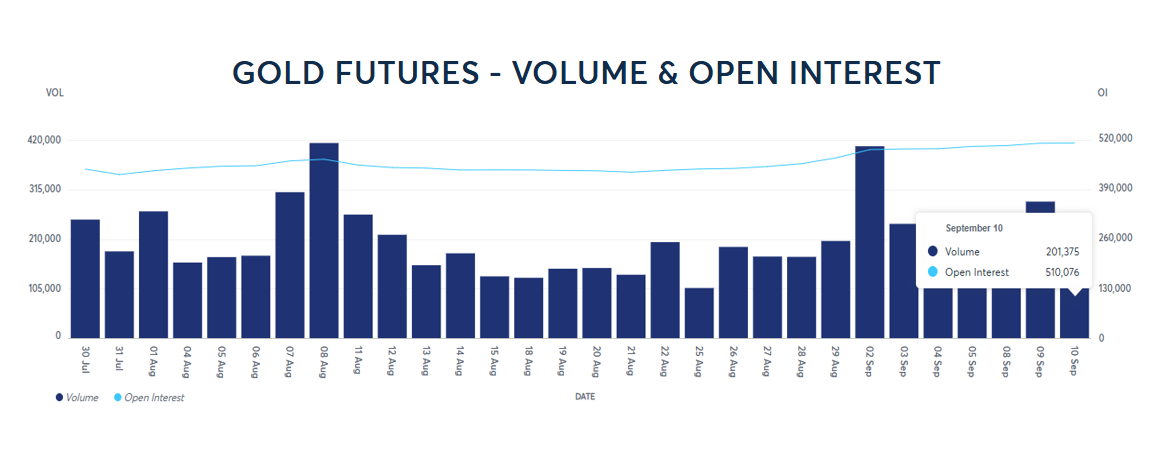

The lack of momentum is also reflected in open interest in gold futures. On September 9, the market recorded 509,000 open contracts with a trading volume of 290,000. On September 10, open interest inched higher to 510,000 contracts, but volume dropped sharply to 201,000 contracts. This shows that the open interest curve is starting to flatten, while the decline in volume reflects lower trading activity. Together, these factors suggest that the gold market is entering a pause or consolidation phase, which explains the current neutrality in XAU/USD movements.

Source: CMEGROUP

If this trend of reduced activity continues, investor interest in gold is likely to remain in wait-and-see mode, at least until the Fed’s decision is released. This pause in bullish momentum, combined with anticipation of upcoming macroeconomic events, reinforces the idea that gold may continue consolidating near its highs, maintaining a neutral bias in the short term.

How Is Market Confidence Evolving?

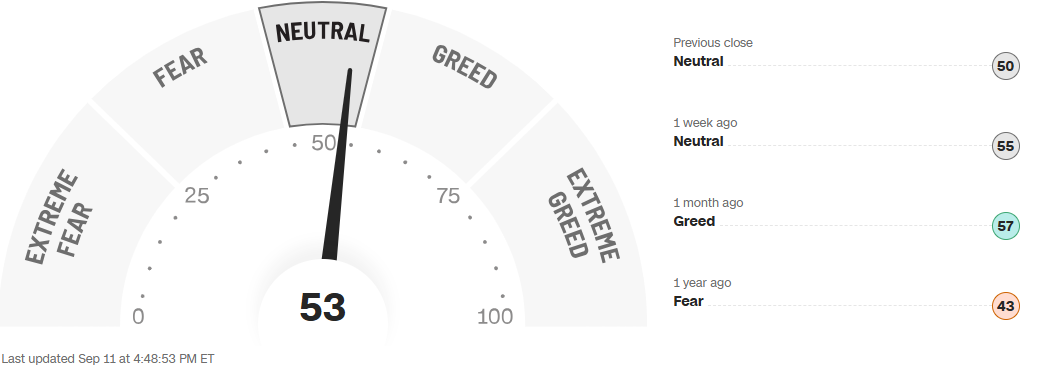

Market confidence indicators also show stability. The CNN Fear and Greed Index stands at 53 points, firmly in neutral territory, with no signals of breaking toward “fear” or “greed.”

Source: CNN

This is significant because, while gold has historically benefited from uncertainty, a strong rebound in confidence could reduce its appeal as a safe-haven asset. When investors display greater risk appetite, demand for gold typically weakens. Therefore, a sustained rise in confidence in the short term could act as a bearish catalyst for XAU/USD, increasing the likelihood of selling pressure in the sessions ahead.

Gold Technical Outlook

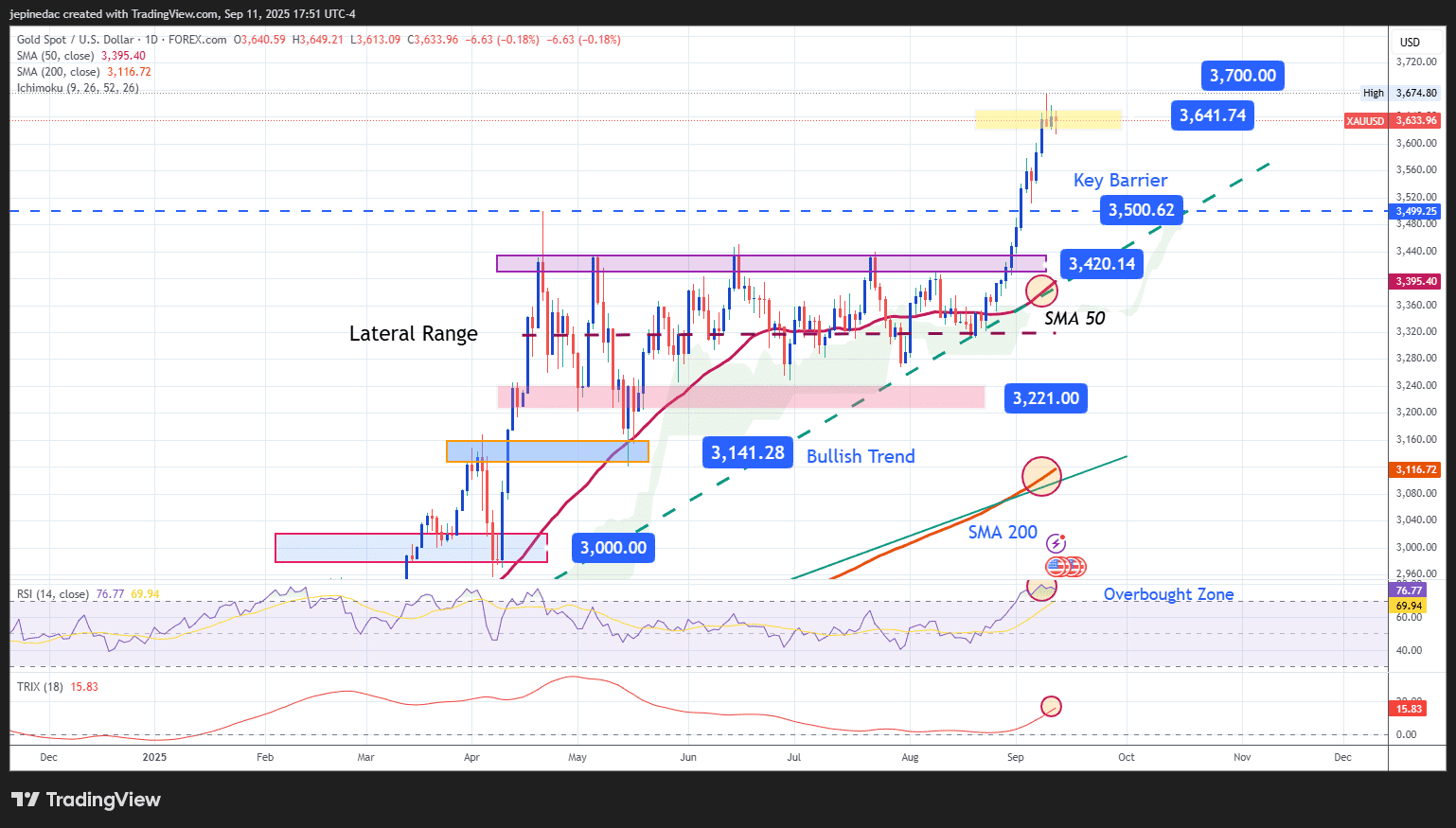

Source: StoneX, Tradingview

- Bullish momentum on pause: Since late August, gold had been riding a strong rally that pushed it to new record highs. However, the area above $3,600 per ounce has proven difficult to break, and the last three sessions have produced neutral candles, confirming that the price is consolidating. This pause opens the door to potential short-term pullbacks, especially if no new catalysts emerge.

- RSI: The RSI remains above 70, firmly in overbought territory, reflecting a clear imbalance in price strength. The rapid ascent of gold in recent weeks increases the risk of downward corrections, as buying momentum begins to lose steam. While this does not signal an immediate trend reversal, it does suggest the market could enter a phase of correction or consolidation.

- TRIX: Meanwhile, the TRIX indicator remains above the zero line, signaling that the medium-term bullish bias in exponential moving averages is still intact. This suggests that despite the current short-term neutrality and risk of corrections, the primary uptrend remains safe, with no imminent threat of a structural breakdown.

Key Levels to Watch:

- $3,700 – Tentative Resistance: A key psychological round number and the first major reference in the absence of previous highs. A strong breakout above this level could pave the way for a more aggressive bullish continuation, reinforcing buyer confidence.

- $3,500 – Nearby Barrier: Formed after a minor correction and serving as the first line of defense against pullbacks. As long as the price holds above this level, gold may retain a neutral-to-bullish bias in the short term.

- $3,400 – Critical Support: The former ceiling of a lateral channel that dominated for several months, now acting as support. A drop back to this level would put the bullish trend at risk and could trigger a more relevant bearish bias.

Written by Julian Pineda, CFA – Market Analyst

Follow him: @julianpineda25