Gold Short-term Outlook: XAU/USD Rebound Testing Key Resistance

August 6, 2025 19:00Gold Technical Outlook: XAU/USD Short-term Trade Levels

- Gold break of yearly uptrend snaps back- rebound now testing resistance at major pivot-zone

- XAU/USD weekly / monthly opening-range taking shape- break to define next leg

- Resistance 3374/81 (key), 3432/51, 3500- Support 3345, 3274/90 (key), 3240/47

Gold broke the yearly uptrend last month, but XAU/USD has since rebounded sharply, with price now testing a critical resistance zone early in the month. This level is key near-term, as a breakout could open the door for another run at the highs. The weekly and monthly opening ranges are taking shape just below. Battle lines drawn on the XAU/USD short-term technical charts.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this gold technical setup and more. Join live on Monday’s at 8:30am EST.

Gold Price Chart – XAU/USD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; XAU/USD on TradingView

Technical Outlook: In last month’s Gold Short-term Outlook we noted that a breakout of the July opening-range kept the focus on a late month high and that the rally, “has extended into near-term uptrend resistance today.” XAU/USD marked an outside-day reversal that day with gold plunging nearly 5% off the highs before rebounding sharply on the heels of Friday’s disappointing Non-Farm Payrolls report.

The advance has been testing confluent resistance for past three-days at 3374/81– a region defined by the 61.8% retracement of the June decline and the record high-day close. Note that the upper parallel of a proposed descending pitchfork converges on this threshold this week and a breach / close above this threshold would be needed to fuel another run towards the highs- looking for a reaction off this mark this week.

Gold Price Chart – XAU/USD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; XAU/USD on TradingView

Notes: A closer look at gold price action shows XAU/USD carving the weekly opening-range just below resistance. Initial support rests at 3345 and is backed by the June close low / August open at 3274/90– losses below this level would suggest a deeper correction is underway with subsequent objectives seen at the May low-day close (LDC) / 61.8% retracement of the May advance at 3240/47 and the 61.8% extension of the decline off the yearly high at 3217.

A topside breach above this pivot zone exposes key resistance at the record high-close / June high at 3432/51– look for a larger reaction there IF reached with a close above needed to mark uptrend resumption toward the record high at 3500 and beyond.

Bottom line: Gold is testing resistance today at a major pivot zone with the weekly / monthly opening-range taking shape just below- look for the breakout to offer guidance here. From at trading standpoint, losses would need to be limited to the monthly open IF price is heading higher on this stretch. A close above 3451 is ultimately needed to fuel the next leg of the broader multi-year uptrend. Review my latest Gold Weekly Technical Forecast for a closer look at the longer-term XAU/USD trade levels.

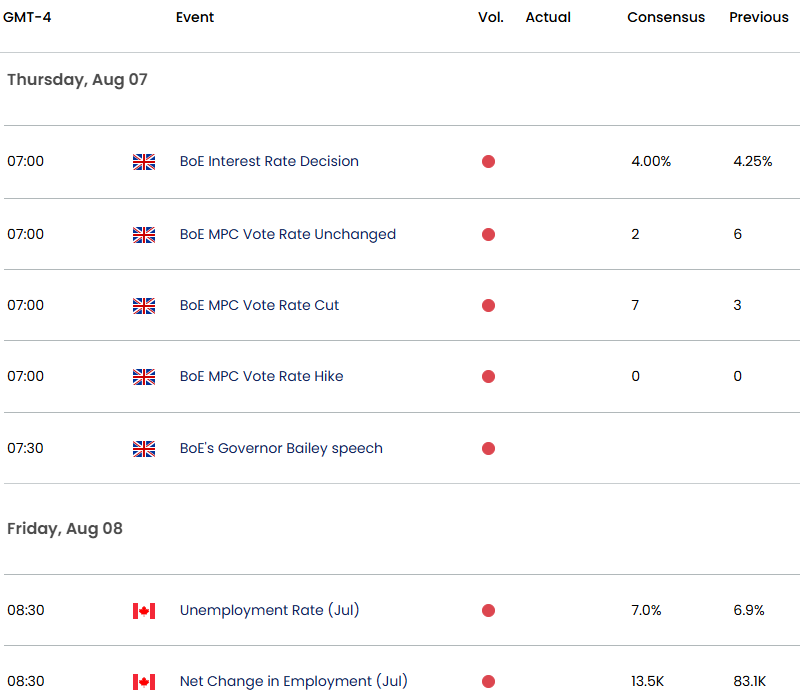

Key Economic Data Releases

Economic Calendar – latest economic developments and upcoming event risk.

Active Short-term Technical Charts

- Swiss Franc Short-term Outlook: USD/CHF Pullback Eyes Uptrend Support

- US Dollar Short-term Outlook: USD Bears Test July Breakout

- Canadian Dollar Short-term Outlook: USD/CAD Hits Uptrend Resistance

- Euro Short-term Outlook: EUR/USD Plunges to Support Ahead of Fed

- British Pound Short-term Outlook: GBP/USD Rally Unravels Ahead of Fed

- Australian Dollar Short-term Outlook: AUD/USD Bulls Eye Breakout

- Japanese Yen Short-term Outlook: USD/JPY Coil Set to Snap

— Written by Michael Boutros, Sr Technical Strategist

Follow Michael on X @MBForex