Gold Price Forecast: XAU/USD Poised for July Breakout

July 2, 2025 22:13Gold Technical Forecast: XAU/USD Weekly Trade Levels

- Gold set to snap two-week decline- key range breakout in focus heading into July

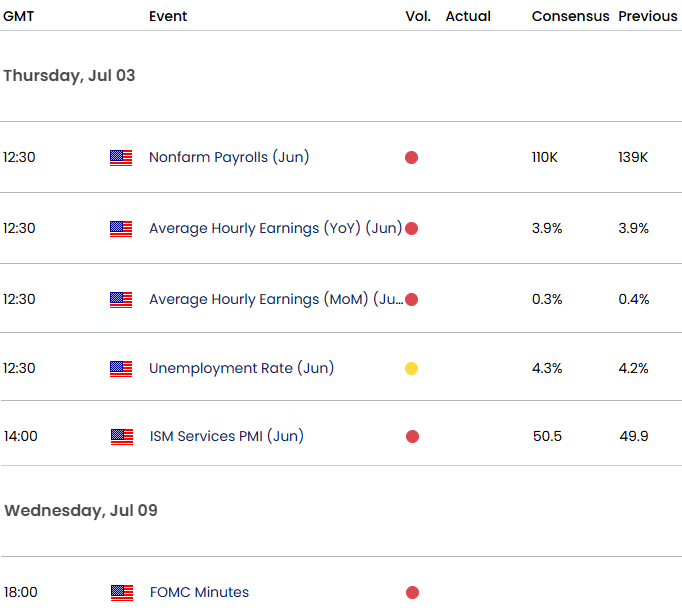

- XAU/USD – U.S. Non-Farm Payrolls on tap tomorrow

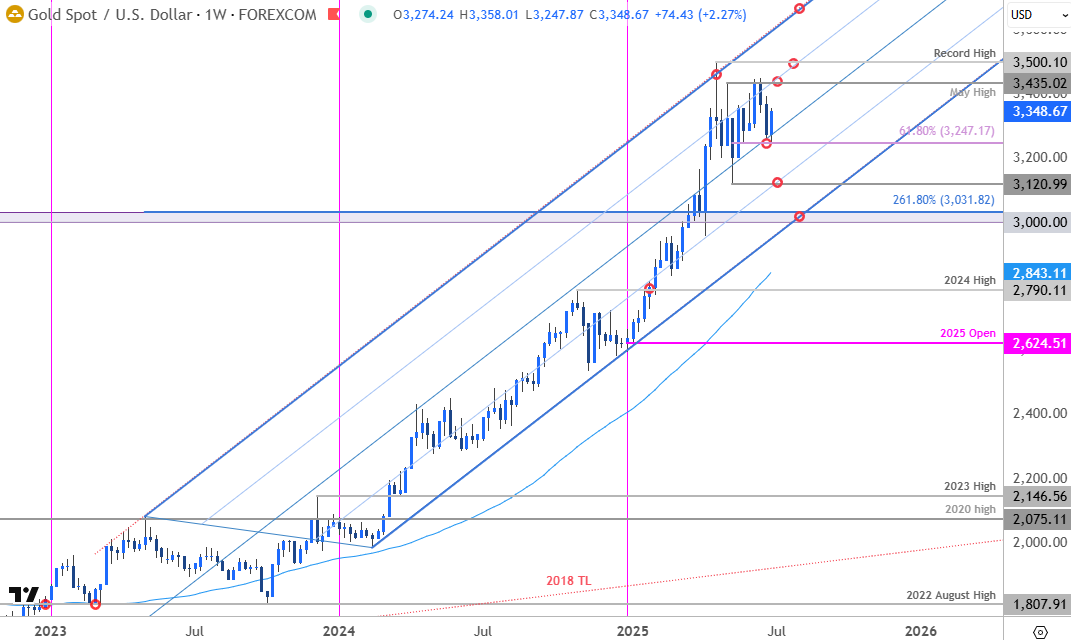

- Resistance 3432/35 (key), 3500, 3630s– Support 3247, 3121, 3000/31(key)

Gold is attempting to snap a two-week losing streak after defending uptrend resistance last week. The focus is a well-defined range breakout heading into July with the bulls still vulnerable while below the record high-close. Battle lines drawn on the XAU/USD weekly technical chart ahead of U.S. Non-Farm Payrolls.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this gold setup and more. Join live on Monday’s at 8:30am EST.

Gold Price Chart – XAU/USD Weekly

Chart Prepared by Michael Boutros, Sr. Technical Strategist; XAU/USD on TradingView

Technical Outlook: In last month’s Gold Technical Forecast we noted that XAU/USD was, “coiled just above the median-line of a multi-year uptrend. From a trading standpoint, the immediate focus is on a breakout of the 3229-3419 for guidance with the bulls still vulnerable while below the 75% parallel.” Gold attempted to breakout the following week with price registering a high-close at 3432 before reversing. The subsequent decline extended nearly 5.9% off the highs to rebound off Fibonacci support this week at the 61.8% retracement of the May rally at 3247. The stage is set heading into June with the immediate focus on a breakout of this six-week range in price.

Resistance is eyed with the record high-close / May high at 3432/35 with a breach / weekly close above 3500 needed to mark resumption of the broader uptrend. Subsequent resistance eyed at the upper parallel, currently near ~3630s.

A break / close below 3247 would threaten a larger correction within the multi-year uptrend. Subsequent support rests at the May low near 3121 with broader bullish invalidation unchanged at 3000/31– both zones of interest for possible downside exhaustion / price inflection IF reached.

Bottom line: Gold is trading in a well-defined range, just below uptrend resistance- look for a breakout in the weeks ahead. From a trading standpoint, the immediate focus is on a breakout of the 3247-3435 range for guidance. Losses should be limited to 3000 for the 2024 uptrend to remain viable with a close above 3500 still needed to fuel the next major leg of the advance.

Keep in mind we are in the early throws of the July opening-range with U.S. Non-Farm Payrolls on tap ahead of the extended holiday weekend. Stay nimble here until we clear this range and watch the weekly closes for guidance. Review my latest Gold Short-term Outlook for a closer look at the near-term XAU/USD technical trade levels.

Key US Economic Data Releases

Economic Calendar – latest economic developments and upcoming event risk.

Active Weekly Technical Charts

- Australian Dollar (AUD/USD)

- British Pound (GBP/USD)

- Canadian Dollar (USD/CAD)

- US Dollar Index (DXY)

- Swiss Franc (USD/CHF)

- Euro (EUR/USD)

- Crude Oil (WTI)

- Japanese Yen (USD/JPY)

— Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on X @MBForex