Gold into FOMC: How Can a Trader Handle Such a Move?

September 16, 2025 19:06Gold Talking Points:

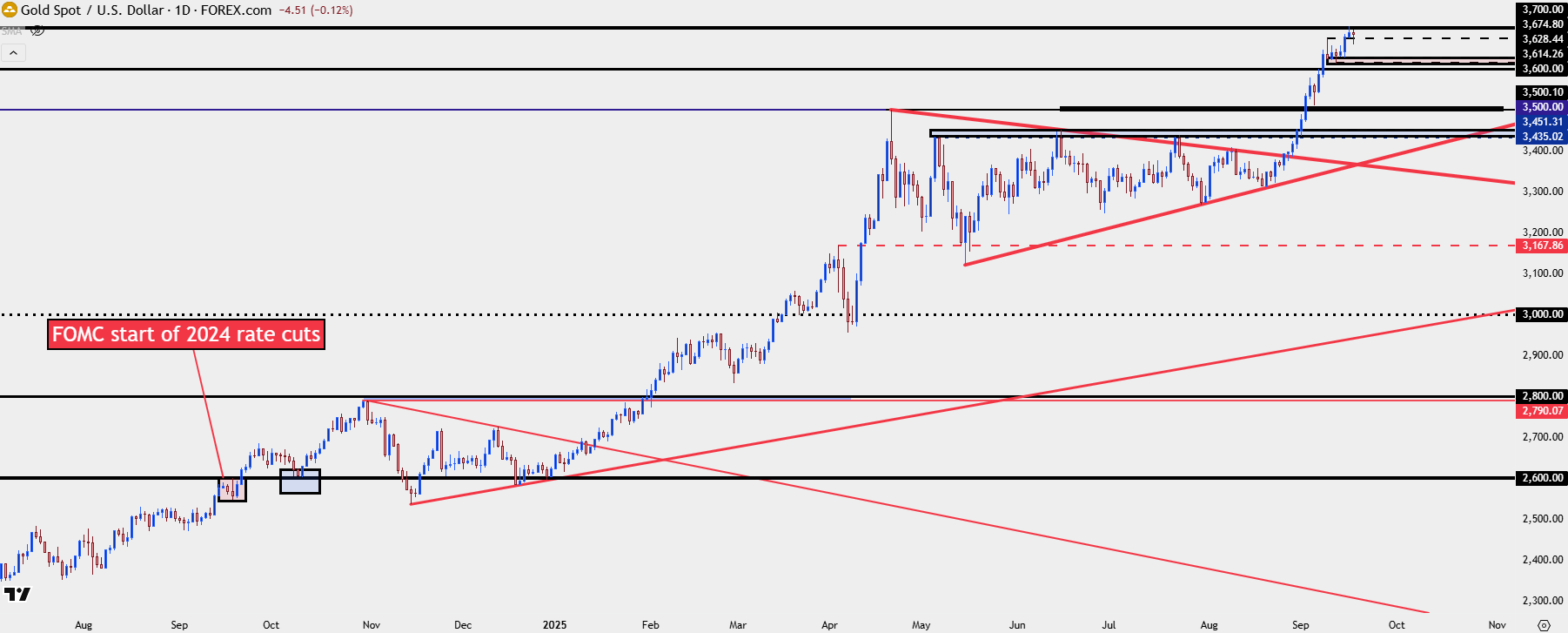

- Gold has been in a near-parabolic like rally since Jerome Powell sounded open to rate cuts at his speech at Jackson Hole on August 22nd.

- The setup ahead of that event seemed favorable for bulls as price held within a bull pennant four months in the making. The question now is whether there’s still room for buyers to run and the answer to that will likely have something to do with just how dovish the Fed appears to be in their projections to be released at today’s meeting.

- Last year when the Fed started their rate cutting cycle, gold actually sold off on that day. The initial move was a press up for the first test of $2600, and that was followed by a brisk sell-off that ran into the end of the session. Gold recovered a day later and soon continued its bullish trend, but don’t underestimate the value of positioning for events like we have today and the move in gold has been very one-sided for the past month or so.

Sentiment plays a big role in price movements and price movements, along with sentiment, can make a large impact on a trader’s psychology. With a parabolic move, it’s that fear of missing out that can sound very loud, encouraging traders to employ bad habits and seek out even sloppy entries, all in hope of taking part in that one-sided trend that’s shown to that point.

But, this is also where matters can get very complicated as sloppy entries can lead to regret and poor risk management.

Last year’s start of rate cuts from the Fed illustrates this well. The metal was bullish ahead of the widely-expected move, although it had stalled just below the $2600 psychological level which, to that point, had never traded in spot gold. I wrote an article highlighting pullback potential into that meeting.

As soon as the Fed announced the rate cut gold rallied up to $2600, and that’s when prices hurriedly began to drop, eventually pushing all the way down to support around 2550 as sellers held into the close of that session. I wrote another article then, highlighting that pullback move.

And then buyers returned with aggression, forcing a new all-time-high shortly after and, eventually, using that same 2600 level as support, which volleyed into yet another fresh ATH. I wrote an article for that one, too.

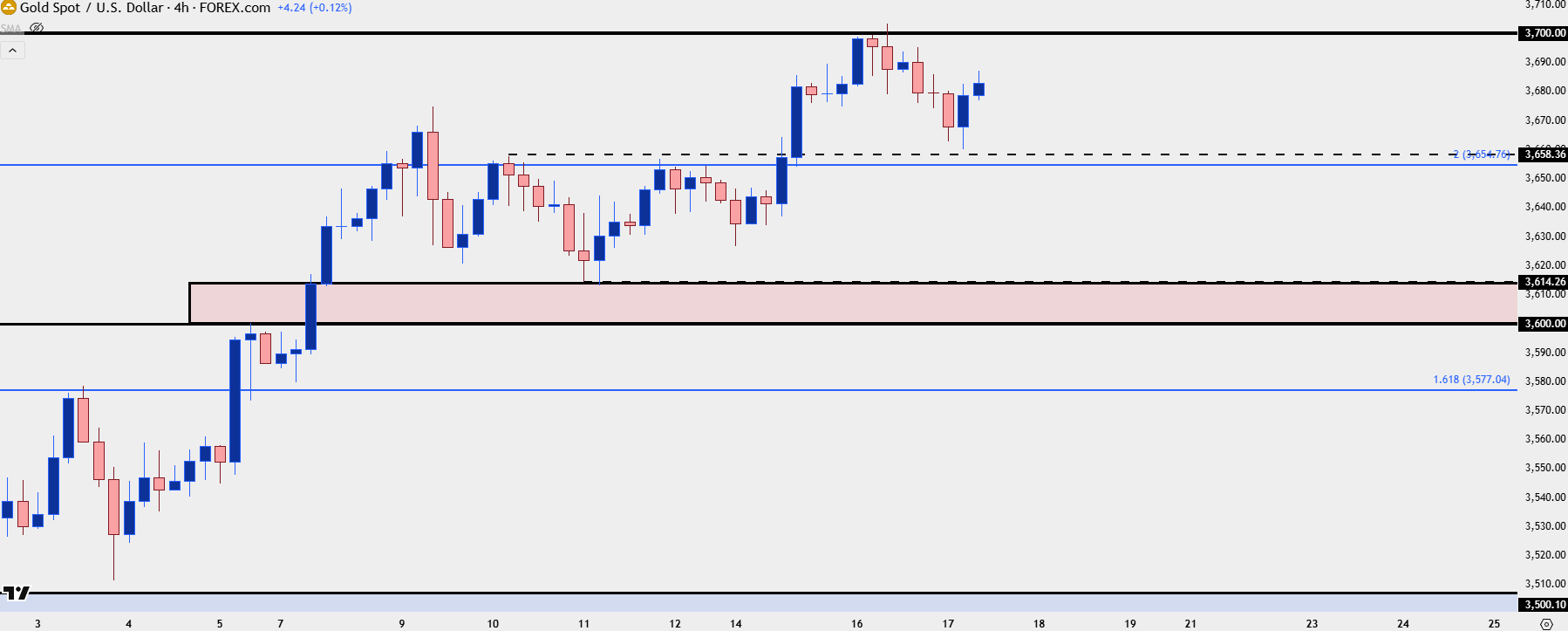

As we go into the FOMC meeting later today, gold is in a similarly stretched position although it has already tested the $3700 level, and that’s showing as current resistance.

Gold Daily Chart

Chart prepared by James Stanley; data derived from Tradingview

Gold: Facts and Transparency

With an event like we have today, opportunity can seem abundant because we’re going to have something ‘new’ to work with, and that newness can produce volatility. For a trader, especially a new trader, that can seem attractive, because that volatility can lead to larger moves in price as that new thing gets priced in, one way or the other.

But with experience one learns that that volatility isn’t a pure positive. While the move may be larger than usual there’s also a wider range of possible outcomes, and thereby a lower probability of ‘guessing’ or finding yourself on the ‘right’ side of the move. So, for news events such as we have today, a lower winning percentage should be expected and, oh, that larger price move, it can work against you, as well, as there’s a possibility that your stop gets wicked by a fast move that ends up reversing before ultimately going in your direction. New traders may respond by removing stops or widening stops, and this can be recipe for disaster as those moves that initially go against you, well, they can keep going against you, and before you know it, a short-term trade can fast become a long-term problem.

Markets are always unpredictable but the rise in volatility can make that lack of predictability even more costly.

Does this mean that news events should be avoided at all costs? Well, it really depends on who you ask. But I do think there could be a way forward for some traders, particularly those that can remain disciplined within their plan while still prioritizing risk management. This isn’t a recommendation in any way, by the way, and if you feel these environments too unpredictable you’re more than welcome to sit on the sidelines and wait for a cleaner backdrop.

We can simply go back to last year as an illustration. Perhaps looking to short gold right after the FOMC announcement of rate cuts starting isn’t a prudent path forward, as that was right in the midst of a high volatility even, with a counter-trend trade and, frankly, a move that didn’t last for very long. So, for that to have worked the trader would not only have had to catch the short with near perfect timing, they would’ve needed to time the bottom almost perfectly, as well.

But – the 2550 support test, which held for a little bit – that offered traders the opportunity to join the trend after the dust had started to settle and given the short-term show of support at that very clear and obvious level, there was an open door for trend continuation. And ultimately, that trend did continue.

That example shows a successful outcome fairly well but you have to realize that not all will play out like that. And, again, experience can go a long way here, because let’s assume failure instead to see the repercussion of that:

For the trader that does have the fear of missing out, and jumps on a breakout like the gold test of 2600 last September, or even the fade of gold at 2600, and let’s assume that ultimately the trade gets stopped out. Well, there’s something (or someone) to blame for that – the trader. Emotion got the best of their judgement and that allowed them to get into a position that they probably wouldn’t have otherwise wanted to do. So, not only is their a capital loss, but there’s mental impact; there’s blame to go around.

But for the trader that did go in with a plan, looking for ways to possibly get long in the direction of the trend in a risk-efficient manner, taking advantage of that news-fueled volatility to instead get a favorable price on an otherwise attractive trend – well, even if that support doesn’t hold and price does continue to dip, that trader had at least stuck to their plan, remained disciplined, and employed a strategy that they actually feel to have an advantage, rather than just chasing news-driven false breakouts.

The other side of this is that by being patient, and waiting for support, the trader also has the chance to limit risk a bit better or at least more efficiently than if chasing a fresh breakout or trying to fade what’s been a fast trend.

The downside of patience and discipline is, of course, that the entry may never come to pass. But for that, I have to ask you, would you rather lose capital on a sub-optimal setup, or miss out on an opportunity and save your capital for setups more favorable to your overall strategy?

Trading psychology is incredibly important to a trader’s long-term success and if you’re beating yourself up for falling prey to temptation of chasing entries around volatile news events, you’re setting up yet another challenge to overcome.

For gold, as noted above there’s a similar backdrop to last year. The market feels incredibly one-sided given the parabolic run that’s developed since the break of the bull pennant formation. And at this point, the question is whether the Fed can help to produce a pullback that can allow for trend continuation.

Below, I look at three different areas of interest for such, with prior resistance of 3654 followed by a zone from 3600-3614 and then another prior resistance level of 3577. If none of those three areas can contain sellers, we may have a larger pullback scenario to deal with and there’s more levels of interest below that.

Gold Four-Hour Price Chart

Chart prepared by James Stanley; data derived from Tradingview

— written by James Stanley, Senior Strategist