Gold Forecast: XAU/USD Reaches $3,700 per Ounce

September 15, 2025 19:04Since the start of the trading week, gold’s bullish momentum has been enough to drive a 1.7% price increase in the short term. The consistent buying pressure, sustained in recent weeks, remains intact as the upcoming Federal Reserve decision approaches, weakening the dollar and allowing gold to gain ground. As long as expectations of lower U.S. interest rates persist and continue to weigh on the currency, current upward pressure on the metal is likely to remain dominant in the coming sessions.

What to Expect from the Fed?

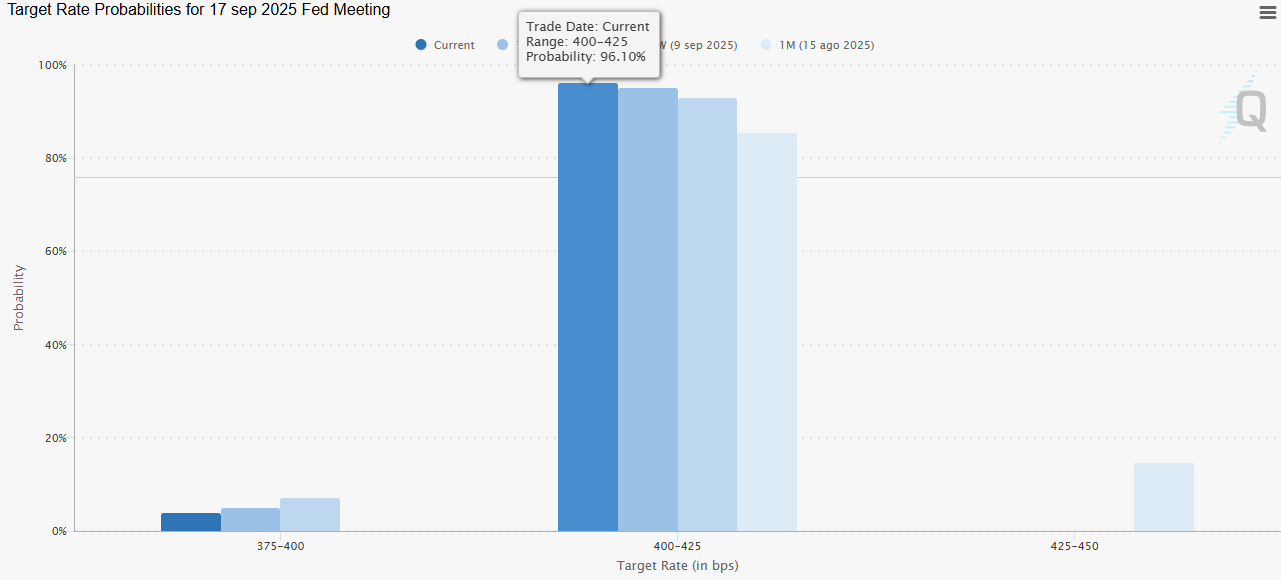

We are on the eve of the Fed’s interest rate announcement, scheduled for tomorrow. All indications point to a 25-basis-point cut, lowering the rate from 4.5% to 4.25%. The CME Group has consistently confirmed this expectation: on August 15, the probability of a cut was 85.41%, and as of today, it has climbed to 96.10%, leaving little room for an alternative outcome.

Source: CMEGROUP

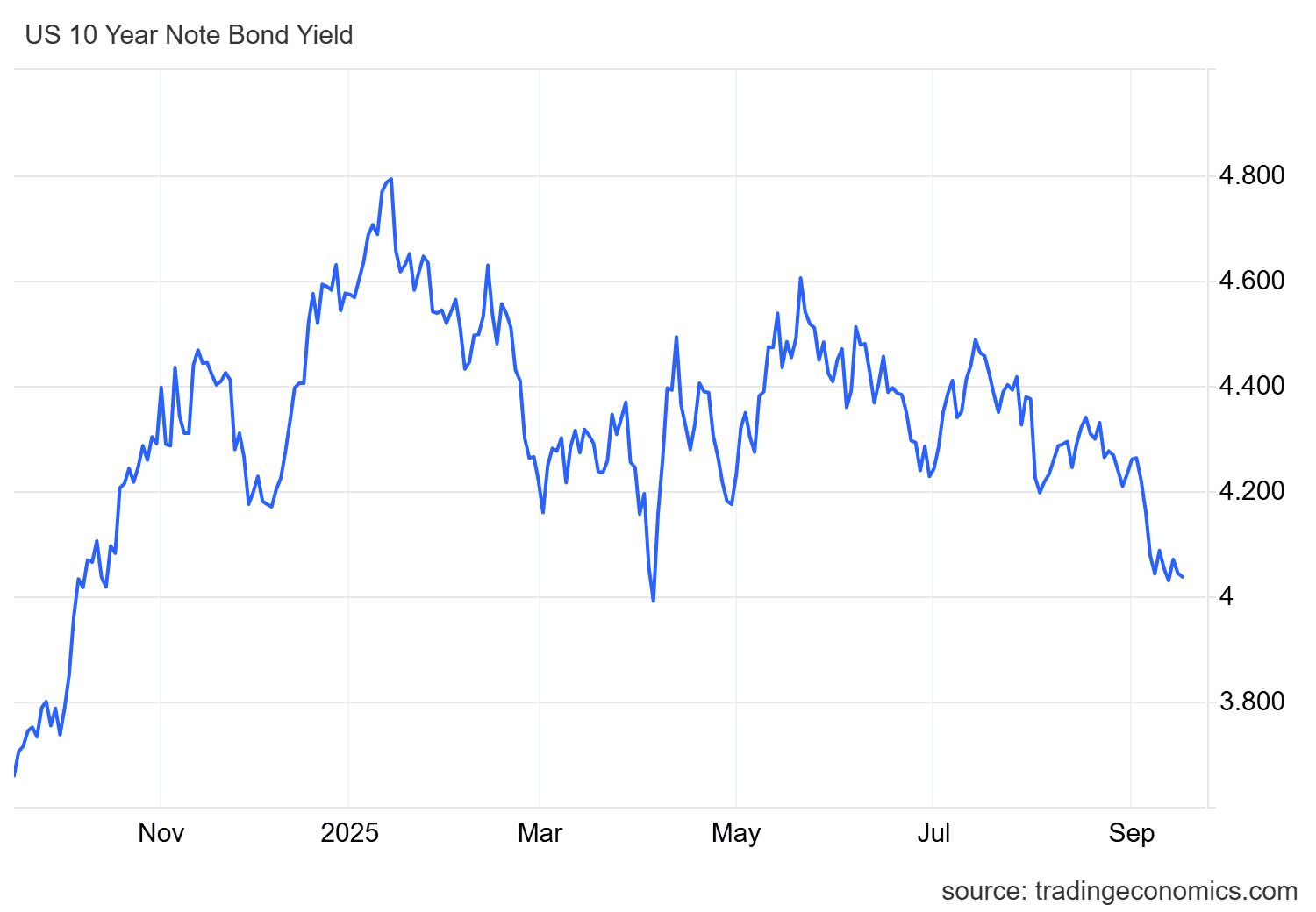

With this scenario nearly confirmed, the impact is also reflected in 10-year Treasury bonds, whose yields have continued to fall toward the 4.0% area, a level not seen since April. So far, there are no signs of a change in this trend: expectations of Fed cuts translate almost directly into yields, reducing their appeal relative to other assets.

Source: TRADINGECONOMICS

This environment is ideal for gold. Both bonds and gold are considered safe-haven assets, but when bond yields weaken, gold gains prominence as a substitute. Since the metal does not offer interest or dividends, it becomes more attractive when instruments that do provide returns lose their profitability. In this way, weakness in fixed income is acting as a key driver for gold demand in the short term.

If the Fed confirms the rate cut tomorrow and reinforces that this will remain its stance for the rest of the year, downward pressure on bonds could continue, supporting gold demand and maintaining the bullish bias in XAU/USD.

Is the Dollar Weakening?

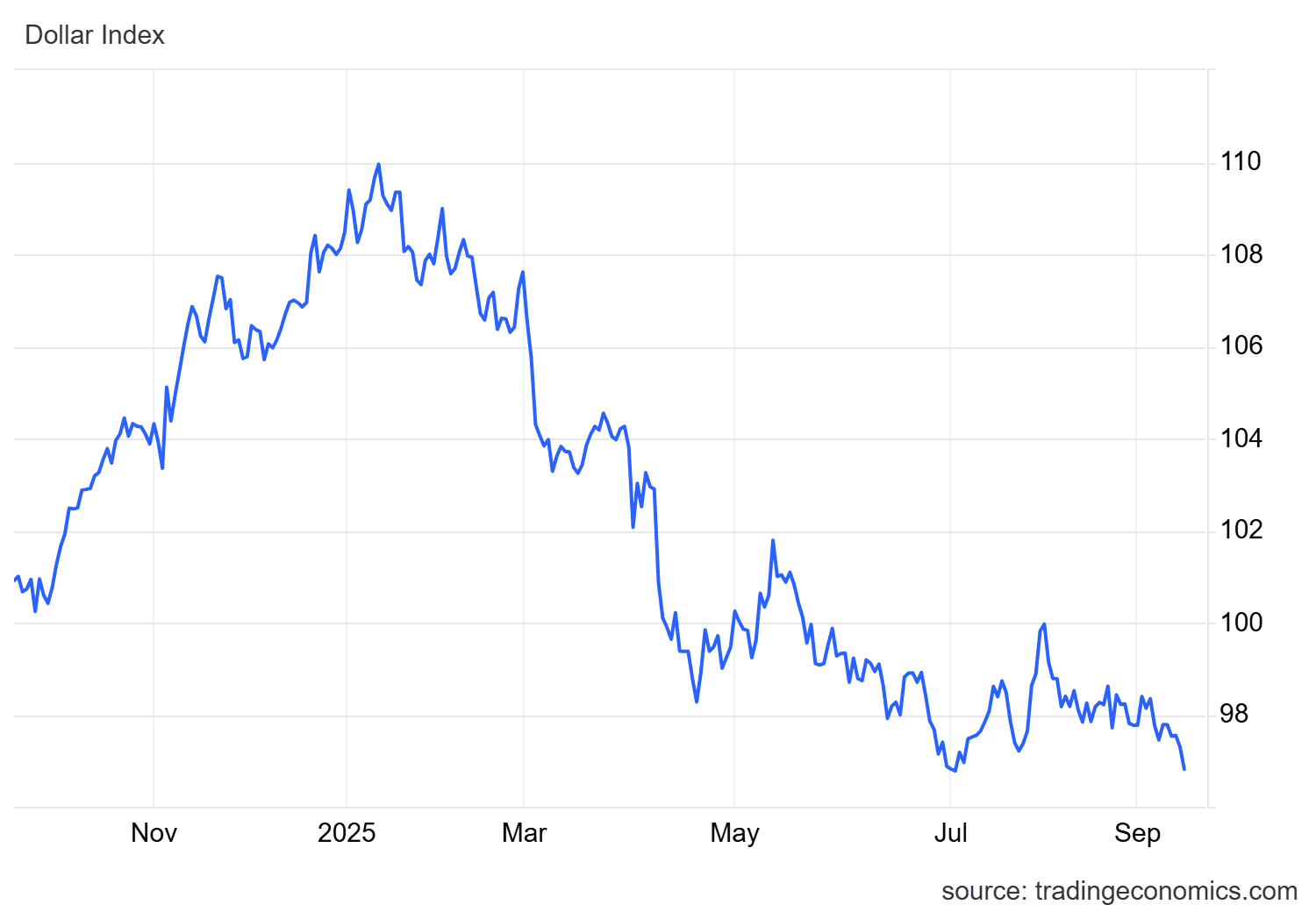

Beyond the bond market, the policy of lower rates is also impacting the U.S. dollar, which has lost strength in recent weeks. The DXY index, which measures its performance against a basket of currencies, has dropped to around 96 points, marking a fresh downward move and pulling further away from the target level of 100 points.

Source: TRADINGECONOMICS

A weaker dollar directly benefits gold. First, because both compete as safe havens: declining confidence in the greenback pushes investors toward the metal. Second, because being denominated in dollars, a weaker currency makes gold more accessible for international buyers, increasing global demand.

In this scenario, as long as the DXY remains in decline and the U.S. currency continues to weaken, buying pressure on gold is likely to remain relevant in the short term.

Gold Technical Forecast

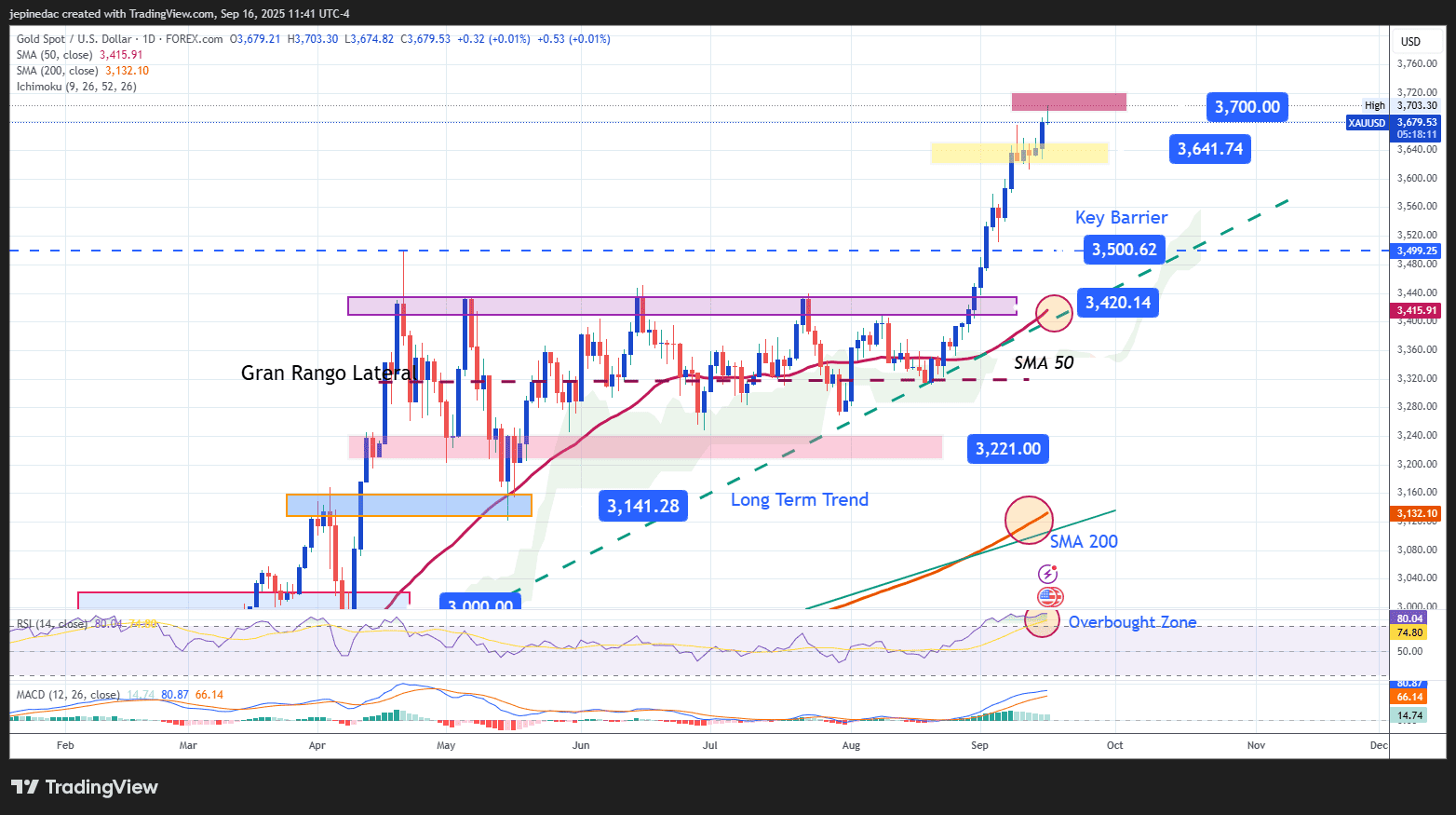

Source: StoneX, Tradingview

- Bullish momentum sets new highs: The rally that began around August 20 has taken gold to a new all-time high of $3,700 per ounce, confirming the prevailing bullish bias on the chart. However, recent sessions have shown some neutrality, which could indicate room for a pause within this long upward move. As long as the price holds near highs, short-term technical corrections cannot be ruled out.

- RSI: The RSI continues to trade above the 70 level, firmly in overbought territory. This reading highlights excessive buying momentum, creating an imbalance in market impulses. The indicator suggests a pause in the trend may be necessary, opening room for downward corrections. The longer the RSI remains in overbought conditions, the greater the risk of price adjustments.

- MACD: The MACD also shows signs of fatigue. While its histogram remains above zero, it has begun to display increasingly lower bars, suggesting that short-term bullish momentum is moderating. This could anticipate a pullback in the coming sessions.

Key Levels to Watch:

- $3,700 – Major Resistance: Marks all-time highs and serves as the most important psychological barrier in the short term. A firm breakout above would reinforce the bullish bias and could extend the dominant trend toward new targets.

- $3,640 – Nearby Barrier: A recent neutrality zone seen in the last sessions, which could act as an intermediate support in the event of short-term pullbacks.

- $3,500 – Critical Support: Corresponds to the former April high, now converted into a key support level. A move down to this area would test the strength of the current uptrend; a break below would increase the risk of a more relevant bearish bias.

Written by Julian Pineda, CFA – Market Analys

Follow him: @julianpineda25