Euro Technical Forecast: EUR/USD Rising Wedge into Jackson Hole

August 18, 2025 19:02Euro, EUR/USD Talking Points:

- It’s a big week for macro themes with the Jackson Hole Economic Symposium on the calendar.

- The US Dollar has been weak for much of 2025 so far but since the Q3 open there’s been a hold of higher-lows. At the center of the matter is whether the Fed can cut interest rates at the September meeting as inflation remains well-above the bank’s target. That’s what puts so much emphasis on FOMC Chair Jerome Powell’s speech at the symposium on Friday.

- I’ll be looking at price action setups around the US Dollar in tomorrow’s webinar and you’re welcome to join. Click here to register.

It hasn’t exactly been a strong start to the year for the Eurozone with year-over-year GDP growth of 1.4% and inflation right around 2.0% as of the last preliminary reading earlier in the month. But, that’s mattered little to the single currency that’s embarked on a strong rally from the January lows at the 1.0200 handle, and behind the push has been the building expectation of rate cuts from the Federal Reserve.

This is quite similar to last Q3 when EUR/USD rallied from an April low around 1.0611 and a June low inside of the 1.0700 level to test 1.1200 in September, right around when the Fed started cutting rates. EUR/USD had become overbought on the daily chart for the first time in a year; and when Q4 opened we saw a quick change as USD-strength took over, US Treasury yields shot-higher and EUR/USD started to tank into and through the US Presidential Election.

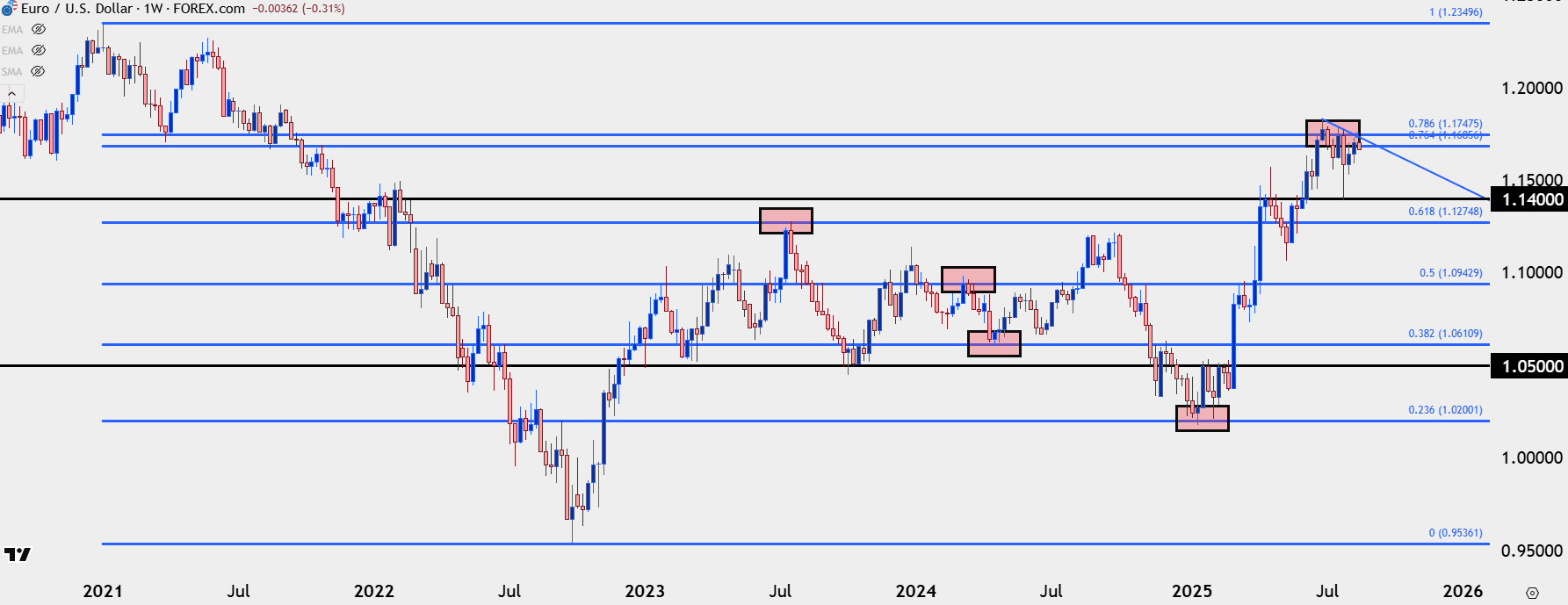

As we came into the year, parity calls for EUR/USD were plentiful. But it was just a couple weeks into 2025 when support caught at the 23.6% Fibonacci retracement of the 2021-2022 major move, and a significant low was in-place. February was a stalling in the move with resistance holding at 1.0500, building an ascending triangle in the pair. And then March is when bulls launched the move higher, driven by recession fears in the US as rate cut expectations started to get priced-in.

EUR/USD Weekly Price Chart

Chart prepared by James Stanley; data derived from Tradingview

USD Weakness, Rate Cut Hopes

Behind the recent push of USD-weakness has been the building hope for rate cuts out of the Federal Reserve. This remains a big question, however, as much of the Fed has so far appeared cautious around such a move given the still-elevated inflation that shows in many of the data points that the bank follows. The CPI report and PPI report from last week both showed inflation above the Fed’s target, and moving higher. The Core PCE report issued last month, just a day after the FOMC rate decision similarly showed inflation growing.

And at the rate decision in July, Powell said that he didn’t feel that policy was overly-restrictive given recent inflation data combined with a stable unemployment rate, which brings on the other side of the Fed’s mandate. The big crush of USD-weakness happened on the release of the NFP report on August 1st, which showed a massive revision-down in the prior two months’ headline figures. But at the FOMC press conference Powell had noted how that could be a noisy data point, and instead, the bank was largely focusing on the unemployment rate and in the NFP report, that printed right at the expected 4.2%, which as Powell had noted, was right around the ‘full employment’ level.

Nonetheless, markets have hurriedly priced-in rate cuts for this year and as of right now there’s a 83.2% probability of a cut in September, along with an 81% probability of at least one more cut by the end of the year.

The big question now is whether Powell opens the door for a September cut that he had seemingly closed at the last FOMC meeting in July. If he does, we could see those odds for rate cuts strengthen while pushing down the USD and, in-turn, pushing up EUR/USD. If we don’t – if he still sounds not ready to usher in lower rates, then we could see that case for USD-strength grow more attractive while setting the stage for a larger-scale EUR/USD reversal.

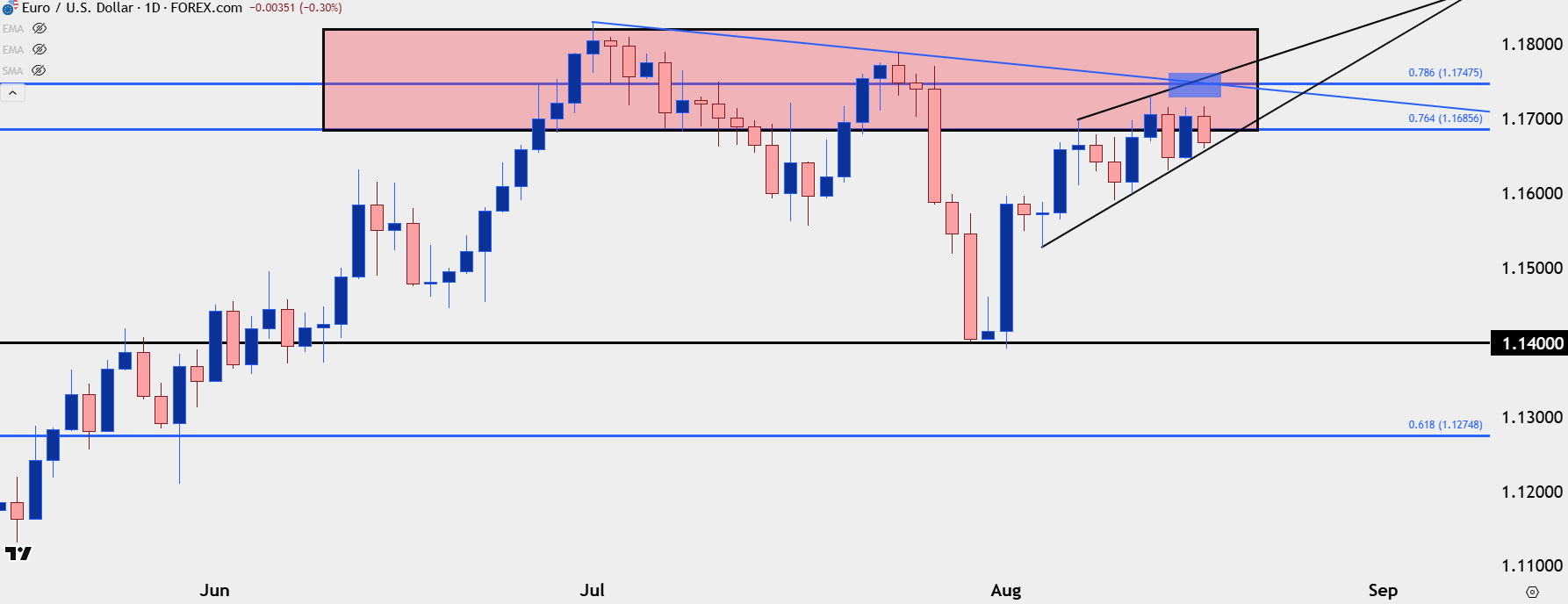

At this point the technical backdrop keeps that alive in EUR/USD as price has built into a rising wedge pattern, often approached with aim of bearish reversal. There’s been a continued hold around the 76.4 and 78.6% Fibonacci levels from the same sequence that came into play to hold the lows back in January and February.

EUR/USD Daily

Chart prepared by James Stanley; data derived from Tradingview

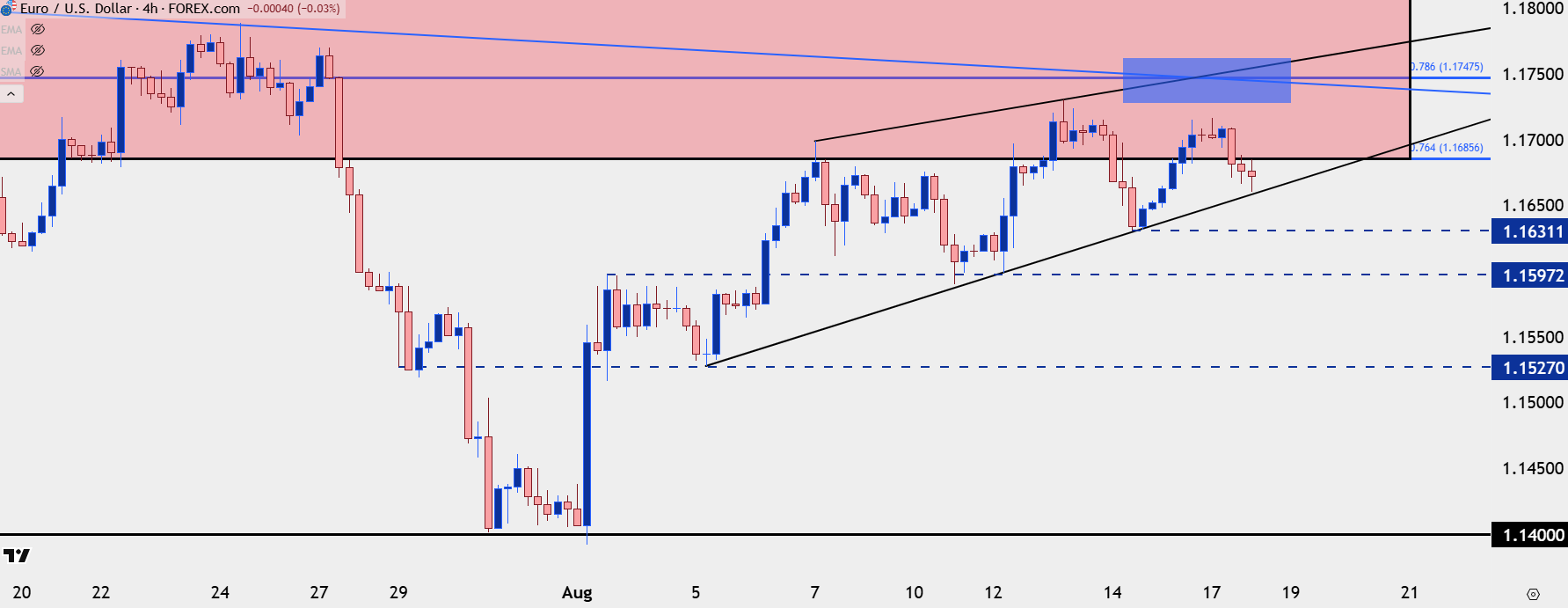

EUR/USD Near-Term Strategy

If looking for USD-weakness, there could be more attractive avenues elsewhere, such as GBP/USD. But for USD-strength, the reversal potential in EUR/USD remains of interest and the rising wedge that’s built over the past couple of weeks illustrates that. And as we saw in July, given how aggressive buyers had pushed trends in EUR/USD in the first-half of the year, evidence of USD-strength could bring on a fast bearish move.

At this point we must first acknowledge the recent bullish structure given holds of higher-lows at 1.1593 and then 1.1631. Breaching those swings would be the first steps for bears to take greater control of the trend. Sitting atop price action, there’s another spot of resistance potential at the 1.1748 level, which is the 78.6% Fibonacci retracement of that 2021-2022 major move, related to the 76.4% marker of the same move that’s showing as shorter-term resistance at 1.1686.

If we do hear Powell take a stronger case against rate cuts, reminiscent of his speech in 2022 when he reminded markets that the Fed’s job against inflation wasn’t yet completed, it’s the 1.1400 level in the pair that would mark potential for a bigger-picture reversal in the pair.

EUR/USD Four-Hour Price Chart

Chart prepared by James Stanley; data derived from Tradingview

— written by James Stanley, Senior Strategist