Euro Short-term Outlook: EUR/USD Plunges to Support Ahead of Fed

July 30, 2025 18:45Euro Technical Outlook: EUR/USD Short-term Trade Levels

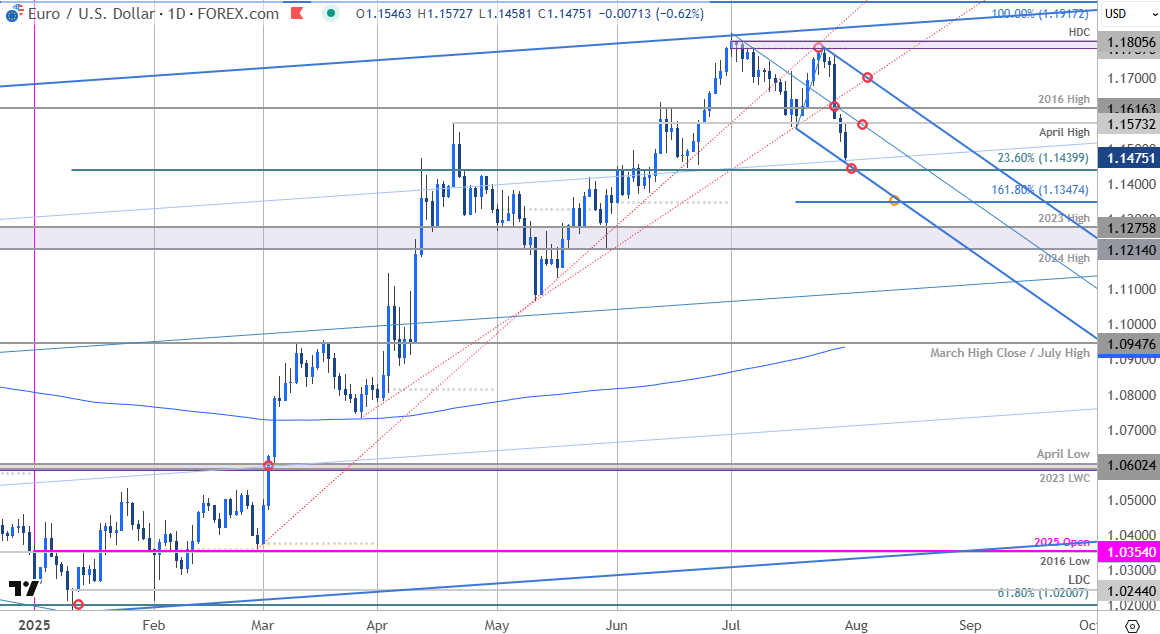

- Euro breaks July range-lows- poised to mark fifth consecutive daily decline

- EUR/USD risk for inflection into near-term support- Fed rate decision, NPFs on tap

- Resistance 1.1573, 1.1616, 1.17 (key)- Support 1.1440, (key), 1.1347, 1.1276

Euro is poised to mark a fifth consecutive daily decline with EUR/USD now off more than 3% from the monthly / yearly high. A break of the monthly range threatens further losses with the bears now testing near-term support ahead of today’s FOMC interest rate decision. Battle lines drawn on the Euro short-term technical charts into August.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this EUR/USD technical setup and more. Join live Monday’s at 8:30am EST.

Euro Price Chart – EUR/USD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; EUR/USD on TradingView

Technical Outlook: In my last Euro Short-term Technical Outlook we noted that, “A reversal off uptrend resistance into the monthly open threatens a larger correction here in EUR/USD.” That high held with a break of the monthly opening-range yesterday plunging to five-week lows ahead of the Fed. The decline takes price into near-term downtrend support today and the focus is on the daily close with respect to this slope- risk for near-term exhaustion / price inflection ahead.

Euro Price Chart – EUR/USD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; EUR/USD on TradingView

Notes: A closer look at Euro price action shows EUR/USD trading within the confines of a descending pitchfork extending off the yearly highs with price testing the lower parallel today in early U.S. trade. The 23.6% retracement of the yearly range rests just lower at 1.1440 and a break / close below this threshold would be needed to suggest a more significant high was registered this month / a larger reversal is underway. Losses below this level exposes subsequent support objectives at the 1.618% extension of the July decline / June open at 1.1347 and the 2023 high at 1.1276– both levels of interest for possible price inflection IF reached.

Initial resistance now eyed at the median0-line / April high at 1.1573 and is backed by the 2016 high at 1.1616. Broader bearish invalidation now stands at the highlighted trendline confluence near the 1.17-handle.

Bottom line: A break below the February uptrend threatens a larger breakdown in EUR/USD. That said, the immediate five-day decline is now testing near-term downtrend support. From at trading standpoint, a good zone to reduce portions of short-exposure / lower protective stops- rallies should be limited to the median-line / 1.1573 IF price is heading lower on this stretch with a close below 1.1440 needed to fuel the next leg of the decline.

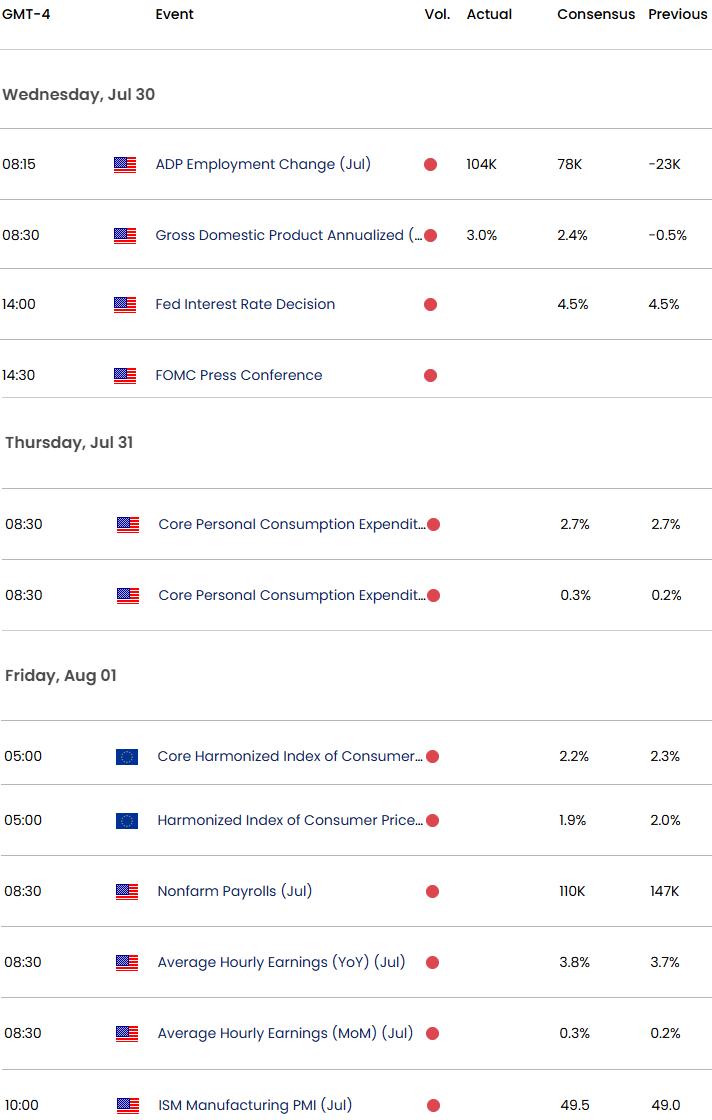

Keep in mind the Federal Reserve interest rate decision is released later today with Non-Farm Payrolls on tap Friday into the monthly cross. Stay nimble into the releases and watch the weekly close here for guidance. Review my latest Euro Weekly Technical Forecast for a closer look at the longer-term EUR/USD trade levels.

Key EUR/USD Economic Data Releases

Economic Calendar – latest economic developments and upcoming event risk.

Active Short-term Technical Charts

- British Pound Short-term Outlook: GBP/USD Rally Unravels Ahead of Fed

- Australian Dollar Short-term Outlook: AUD/USD Bulls Eye Breakout

- Gold Short-term Outlook: XAU/USD Breakout Eyes Record Highs

- Swiss Franc Short-term Outlook: USD/CHF Rejected at Resistance

- Canadian Dollar Short-term Outlook: USD/CAD Coils Below Key Resistance

- US Dollar Short-term Outlook: USD Bulls Eye Breakout at Resistance

- Japanese Yen Short-term Outlook: USD/JPY Coil Set to Snap

— Written by Michael Boutros, Sr Technical Strategist

Follow Michael on Twitter @MBForex