EUR/USD Update: The Euro Pauses Its Bullish Momentum Ahead of the FOMC Decision

September 16, 2025 17:58The day of the Federal Reserve has arrived, bringing with it a pause in EUR/USD movements, as the pair records a short-term decline of around 0.23%. The pair has entered a neutral bias, as investors wait closely for the comments that will follow the U.S. central bank’s policy decision. These remarks could act as the main catalyst for the pair’s next moves. If the Fed reinforces the need to keep interest rates lower, buying pressure on the euro, which had stalled in recent sessions, could regain relevance in the coming days.

Fed Decision Day

At 2:00 p.m. ET today, the Fed will release its official rate decision, with the market pricing in more than a 90% probability of a 0.25% cut, lowering the reference rate from 4.5% to 4.25%, according to the CME Fed Watch Tool. However, the most important event will be the press conference with Jerome Powell at 2:30 p.m. ET, where he will explain the reasons behind the decision and, more importantly, provide guidance on whether this cut will be the start of a cycle of reductions that could extend through year-end.

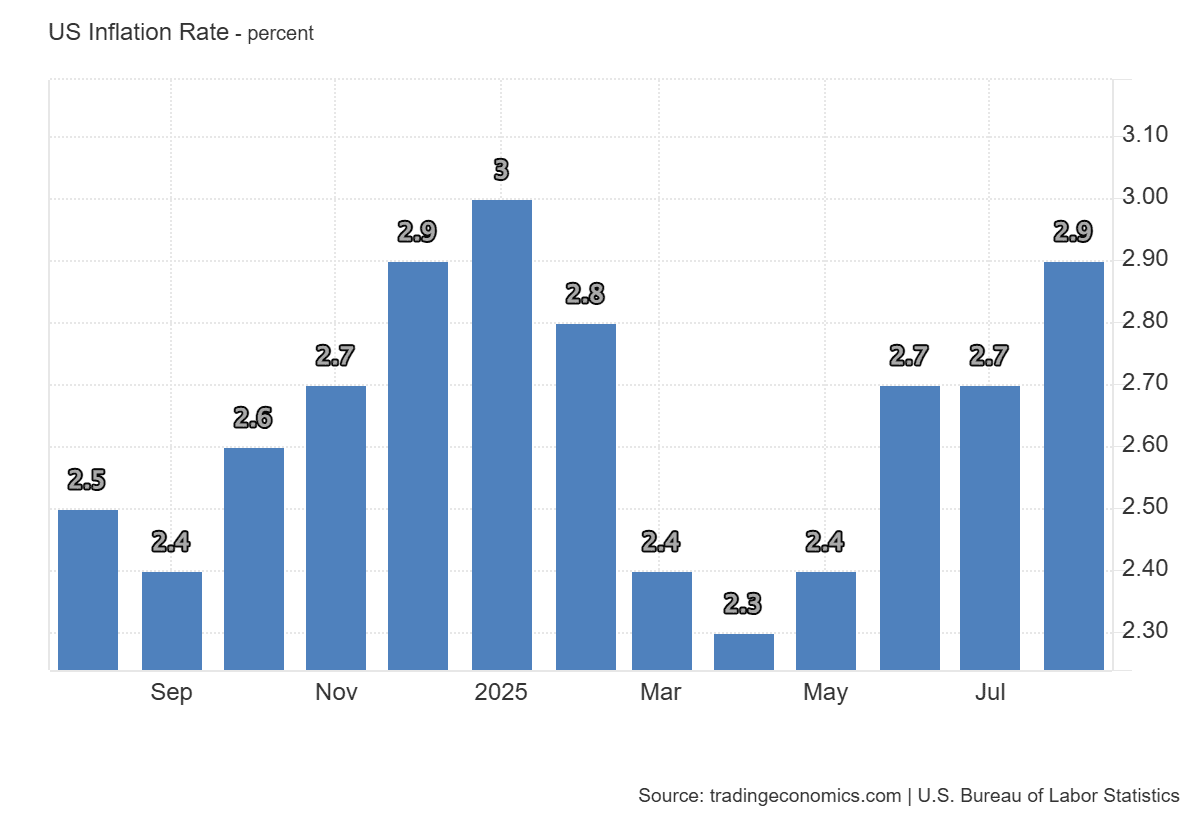

The key focus will be on inflation, as the annual CPI has shown steady growth in recent months. It was 2.3% in April and rose to 2.9% in August, moving further away from the Fed’s 2% target. This uptick raises doubts: will the Fed interpret it as a risk strong enough to slow the pace of cuts? If the central bank prioritizes controlling inflation, it could soften its message and adopt a more neutral stance in upcoming decisions. Such a shift would immediately affect confidence in the dollar and, consequently, could begin to weigh on the bullish momentum that EUR/USD has maintained in recent months.

Source: TRADINGECONOMICS

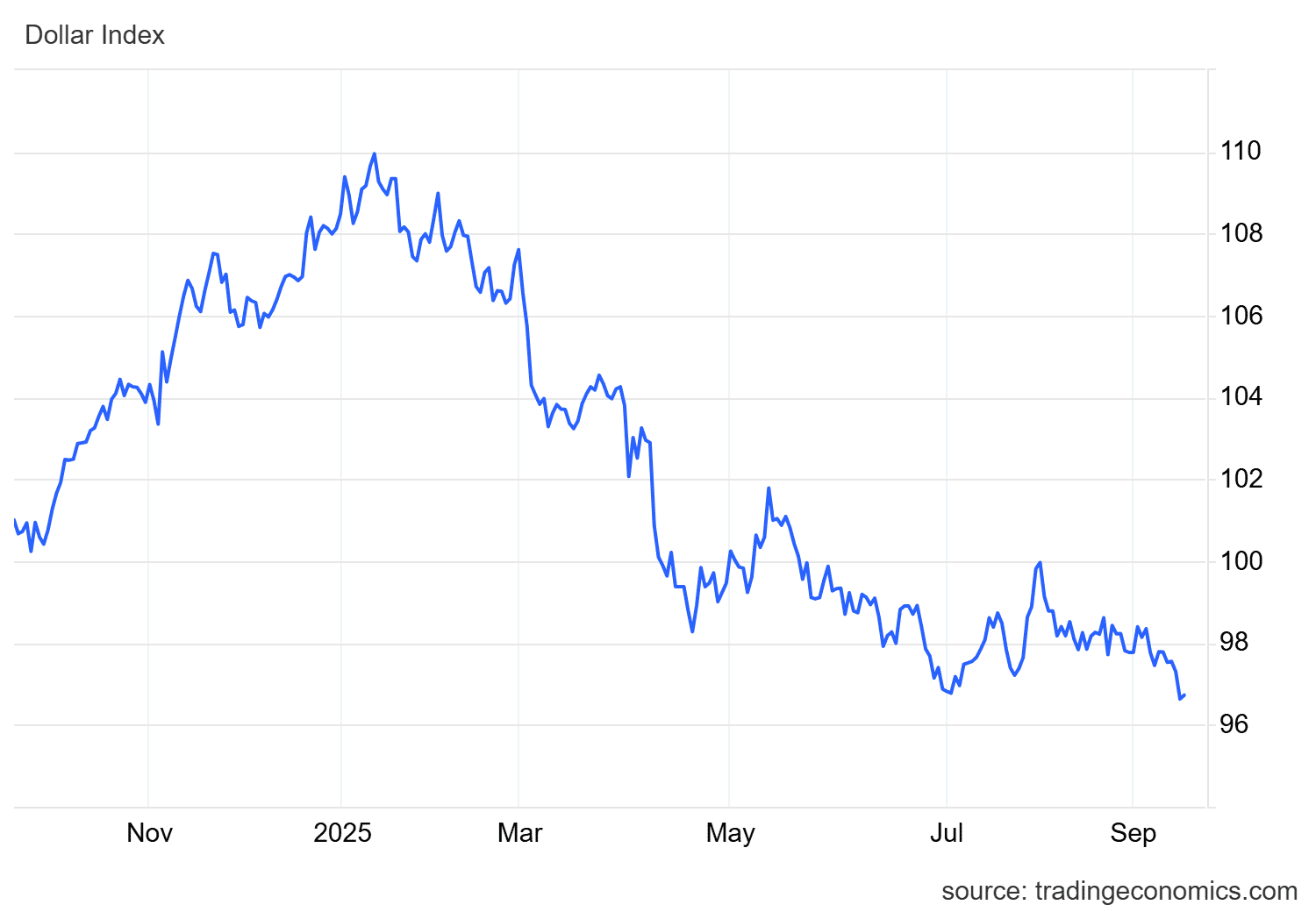

The expectation of lower rates has already weakened the U.S. dollar in recent weeks. The DXY index, which measures the dollar’s performance against a basket of currencies, continues to show a steady downtrend, approaching 96 points, a level corresponding to its yearly lows. So far, there are no clear signs of a reversal, and this ongoing loss of confidence in the dollar has consistently favored the euro, which has gained ground steadily in recent months.

Source: TRADINGECONOMICS

Given this, the market remains on edge about the Fed’s direction. In one scenario, if it confirms a policy of successive cuts, the dollar could continue losing appeal, boosting the euro and maintaining buying pressure in EUR/USD. In another scenario, if inflation data weigh more heavily on the decision and a pause in cuts is mentioned, the dollar could regain confidence, which would pose a risk to the euro’s recent bullish trend.

What Does the European Central Bank Think?

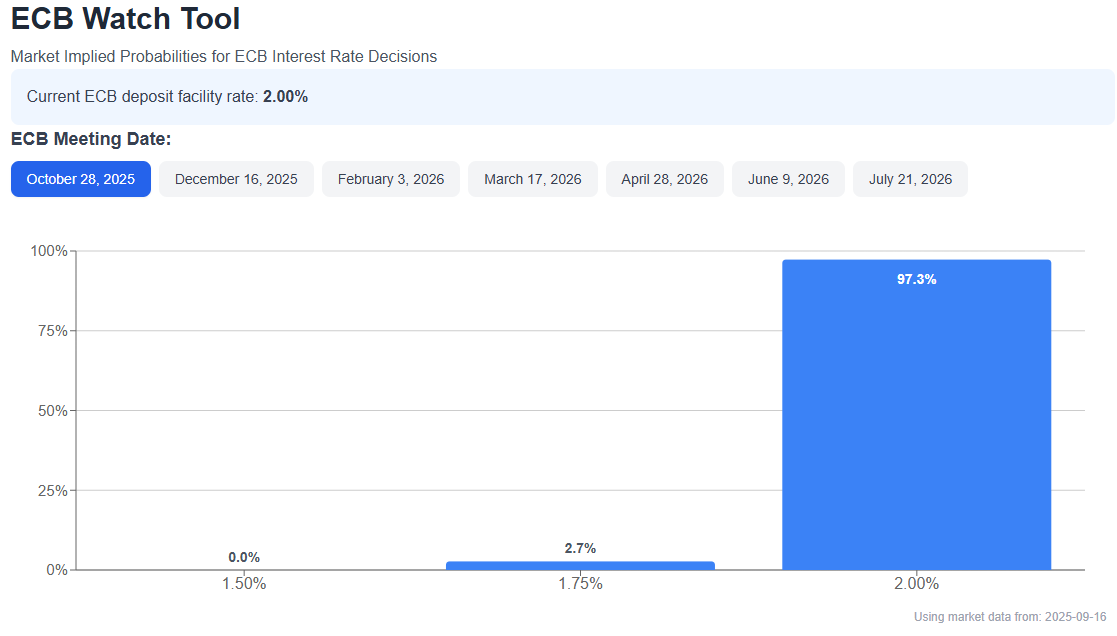

Meanwhile, the European Central Bank (ECB) maintains a clearly neutral stance. The ECB Watch tool shows a 97.3% probability that the deposit rate will remain at 2% at the October 28 meeting, unchanged. This highlights a key divergence compared to the Fed’s stance, which seems headed toward more cuts.

Source: ECBWATCH

This difference in perspectives between the two central banks could benefit the euro in the short term. If the U.S. cuts rates while Europe holds steady, the differential would narrow, increasing the appeal of euro-denominated assets relative to those in dollars. As a result, this divergence in policies could become a key catalyst for EUR/USD to sustain buying pressure in the short term.

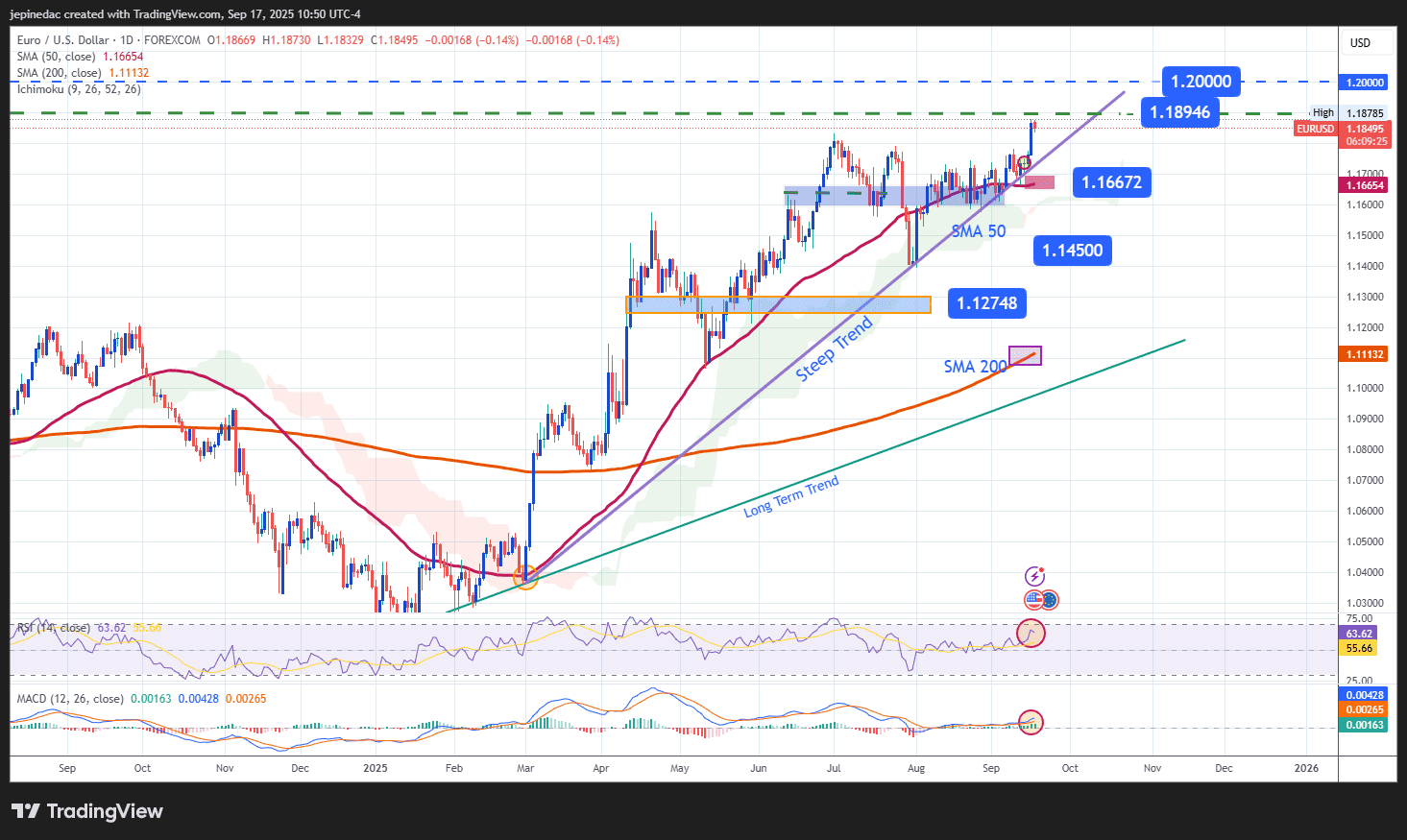

EUR/USD Technical Forecast

Source: StoneX, Tradingview

- Uptrend remains intact: Since early March, EUR/USD has shown a solid bullish structure, with no clear signs of a major correction so far. As long as buying pressure persists, the pair could once again move toward the 1.2000 area in the short term.

- RSI: The RSI remains in positive territory, with readings above 50, indicating that bullish impulses have dominated the last 14 sessions. This behavior suggests that buying pressure could intensify in the near term.

- MACD: The MACD histogram continues above 0, reflecting strength in the moving averages and confirming an overall bullish bias. So far, the market shows little room for prolonged neutrality.

Key Levels:

- 1.18946 – Nearby Resistance: A neutrality zone seen on the weekly chart, acting as the first barrier for the bullish trend. If rejected, it could trigger short-term corrections.

- 1.20000 – Major Resistance: A key psychological level. A clear breakout above could trigger a more aggressive bullish move and reinforce a stronger buying trend in the short term.

- 1.16672 – Final Support: Linked to the 50-period simple moving average, this is the most critical support level. A drop back to this area would put the current uptrend at risk and open the door to a more dominant bearish bias.

Written by Julian Pineda, CFA – Market Analyst

Follow him: @julianpineda25