EUR/USD Outlook: Euro Continues Push Toward Yearly Highs

August 8, 2025 22:20The EUR/USD pair has posted a gain of just over 1% over the last five trading sessions, driven by a steady strengthening of the euro. For now, the bullish bias remains intact in a context where central banks continue to play a decisive role. Currently, buying pressure is dominant, mainly because markets expect a lower interest rate environment in the U.S., which could further weaken the dollar. This expectation has become the main catalyst behind the current move, and if it persists, we could see more sustained buying interest in EUR/USD in the short term.

What’s Going On With Central Banks?

The divergence between the Federal Reserve and the European Central Bank remains wide: the U.S. maintains a 4.5% rate, while Europe holds its deposit rate at 2.00%. However, what’s beginning to shift is the future policy outlook. The Fed has started signaling that it may enter a rate-cutting cycle in the near term, which could significantly reduce the relative appeal of the dollar.

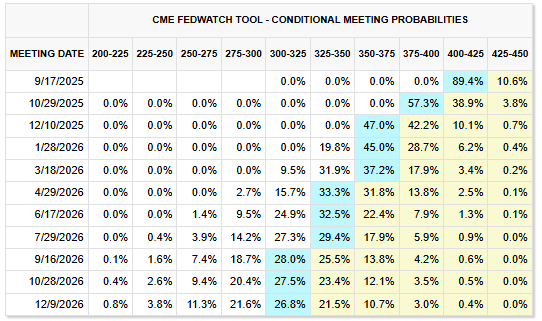

This expectation is already reflected in the markets. According to CME Group, the probability of a rate cut to 4.25% on September 17 has risen to 89.4%. Moreover, for the October 29 meeting, there’s a 57.3% chance of a further cut to 4.00%.

Source: CMEGroup

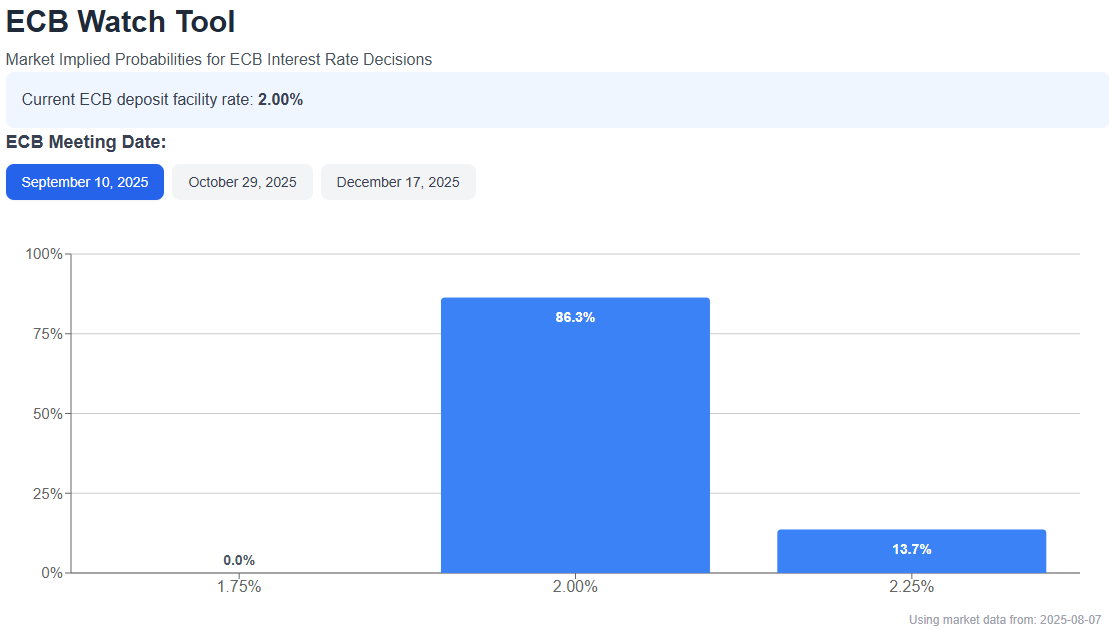

In contrast, the ECB appears to have ended its long cycle of rate cuts. The probability of the deposit rate remaining at 2.00% at the next meeting on September 10 stands at 86.3%, suggesting that the ECB now views a neutral monetary stance as appropriate after several reductions earlier this year.

Source: EcbWatch

This shift in outlook is beginning to affect the dollar’s strength. While U.S. rates remain higher than Europe’s, the market is pricing in a declining yield environment, which may reduce demand for dollar-denominated assets. If expectations of Fed cuts solidify, the euro could continue to gain ground, especially if the ECB maintains its steadier course.

Is Dollar Weakness Becoming Structural?

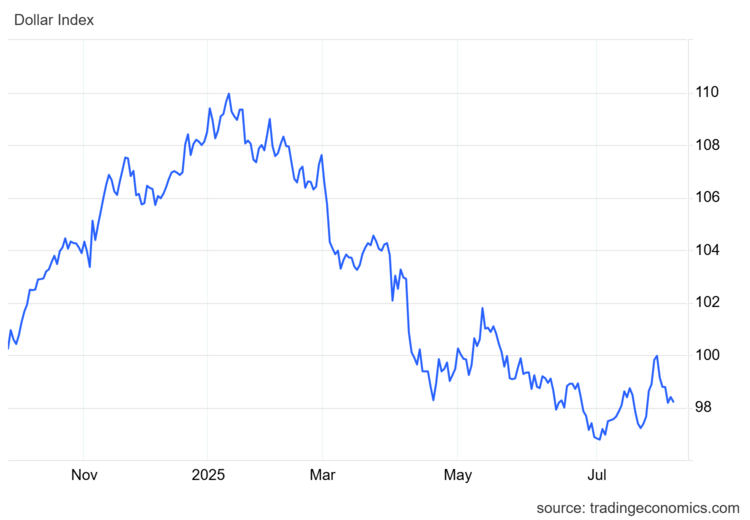

The U.S. dollar’s weakness has become more evident through the behavior of the DXY index, which tracks the greenback against a basket of currencies. In recent days, the index has dropped below the 100-point mark, now hovering near 98, signaling a new bearish push for the dollar.

Source: TradingEconomics

This decline appears directly tied to expectations of a more dovish Fed, and if the DXY continues to correct lower, selling pressure may increase further. In this scenario, EUR/USD could maintain upward momentum, supported by capital flows shifting away from the dollar in favor of currencies with more stable outlooks.

EUR/USD Technical Outlook

Source: StoneX, Tradingview

- Bullish Trend Tries to Consolidate: Although the euro saw notable pullbacks in recent weeks, a new bullish impulse has begun to form, aiming to reclaim the highs of recent months. If buying pressure holds, the pair may successfully rebuild the positive trend structure it had temporarily lost.

- RSI: The Relative Strength Index has returned above the 50 level, indicating a recovery in bullish momentum. If this trend continues, it could reinforce the short-term upward bias.

- ADX: The ADX line, however, remains below 20, suggesting low market volatility. Unless this technical condition changes, the market may continue alternating between brief advances and neutral phases until a stronger catalyst emerges.

Key Levels:

- 1.18196 – Major Resistance: This level marks the yearly high and is the most important barrier for buyers. A sustained breakout above it could open the door to new highs, confirming a more robust bullish phase.

- 1.16286 – Nearby Support: Aligned with the 50-period simple moving average, this zone could act as a temporary technical barrier if short-term pullbacks occur. Holding above it will be critical to preserve the bullish bias.

- 1.14522 – Critical Support: This level corresponds to the 23.6% Fibonacci retracement and represents the most important downside level. A return to this zone could signal a structural shift, paving the way for a short-term bearish trend if buying momentum doesn’t recover.

Written by Julian Pineda, CFA – Market Analyst

Follow him on: @julianpineda25