EUR/USD forecast: Technical Tuesday, July 8 2025

July 8, 2025 15:26- EUR/USD forecast starting look a little negative as US dollar steadies

- Equities remain resilient despite tariff noise; Trump says Aug 1 deadline “not 100% firm”

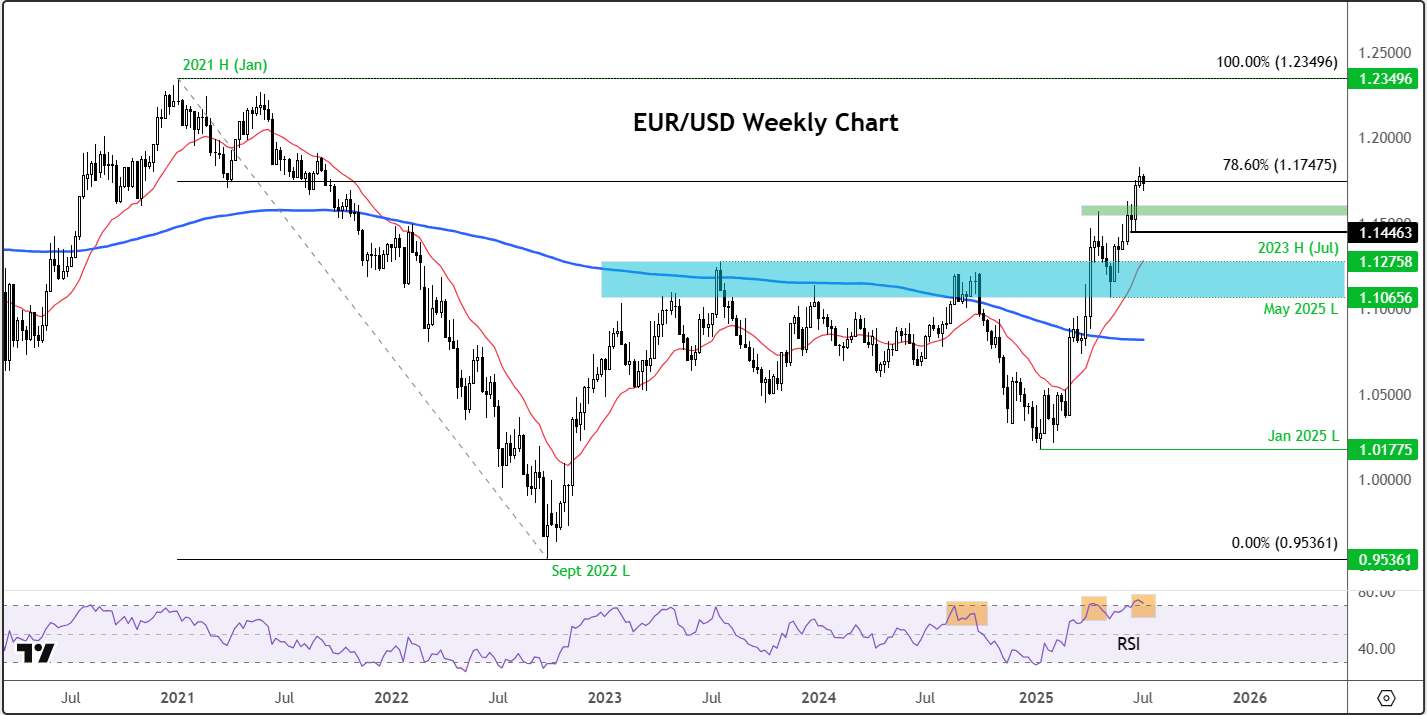

- EUR/USD chart showing overbought signals as correction risks grow

Markets have taken the latest tariff threats from Trump in their stride. Equity indices were quick to recoup most of their losses, with US futures trading higher and the DAX hitting a new weekly high today, reaching its highest levels since early June. In FX, the dollar has turned mixed, rising against the European major currencies, while weakening versus commodity dollars following that surprise RBA rate hold overnight and the firmer risk tone. Meanwhile, gold has fallen out of favour in preference to racier equity and crypto markets, with firmer bond prices and dollar also applying pressure. Investors presumably expect more deals to be done before the extended August 1 deadline. After all, Trump himself has said that he’s open to negotiations and that the August 1 deadline for implementation of new levies was “not 100% firm”. The EUR/USD forecast has not turned outright bearish yet, but some signs of technical weakness are now starting to emerge.

EUR/USD forecast: Tariffs Fail to Shake Dollar’s Broader Narrative

Trump’s widely expected decision to dispatch letters starting yesterday proposing higher tariffs to major trading partners caused an initial wobble in US equity futures but most of those losses have already been clawed back, while markets in Japan, South Korea and Germany, are trading even higher than Friday’s close. Markets are, quite reasonably, treating the letters as negotiation theatre rather than a firm policy pivot. You can’t be taken seriously if you keep changing deadlines and making last minute changes all the time. Indeed, Trump himself has said that he’s open to negotiations and that the August 1 deadline for implementation of new levies was not 100% firm.

What’s perhaps more telling is that US equities seem increasingly desensitised to this back-and-forth, which bodes well for broader risk appetite. For FX markets, too, investors seem to have decided that the economic fallout from higher tariffs will not suppress business confidence materially or spark major job losses. But the rising yields suggests that higher tariffs, together with Trump’s tax cut plan, will probably underpin inflation, reducing the likelihood of a sooner-than-expected rate cut from the Federal Reserve. For that reason, the US dollar is starting to climb back against lower yielding currencies.

As we head deeper into Q3, the argument for a modest dollar rebound looks increasingly favourable with inflation expectations on the up again and the Fed still on pause in terms of rate cuts. Meanwhile, the European Central Bank is expected to cut rates further following their last cut in early June. As yield differentials favour the dollar, and trade war fears recede further, the EUR/USD forecast is starting to look a little bearish at these levels.

Technical EUR/USD forecast: Key levels and trends to watch

Let’s now look at the daily and weekly time frames of the EUR/USD to highlight a few technical levels and work out the most likely technical path moving forward.

Starting with the weekly chart of the EUR/USD, the Relative Strength Index (RSI) is above the “overbought” threshold of 70.0. While the past is not always a reliable indicator of the future when it comes to technical analysis, the RSI being at these levels have invariably preceded corrections of consolidation phases in the underlying EUR/USD exchange rate. So, don’t ignore the weekly RSI, although this alone does not mean the top is in or near.

Looking at the daily chart, the EUR/USD looks to be in a healthy trend with minimal pullbacks. While the bullish trend line remains in place, any short-term weakness we will now see should be treated as a normal pullback inside a larger uptrend – until the charts tell us otherwise.

If and when the trend line breaks, that’s when the near-term technical EUR/USD forecast will be confirmed as bearish. With the that in mind, the most important support area to watch is between 1.1570ish to 1.1630ish, where previous resistance meets the bullish trend line and the 21-day exponential average.

Source for all charts used in this article: TradingView.com.

— Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R