The EUR/USD pair posted a 1% gain by the end of the week, driven by the euro’s rebound following the latest Non-Farm Payrolls (NFP) report in the United States. For now, the bullish bias remains intact, as the euro continues to gain ground against a weakened dollar, pressured by the resurgence of trade tensions and ongoing disappointment in labor market data. If these factors persist, buying pressure on EUR/USD could strengthen further in the short term.

NFP Day Arrives

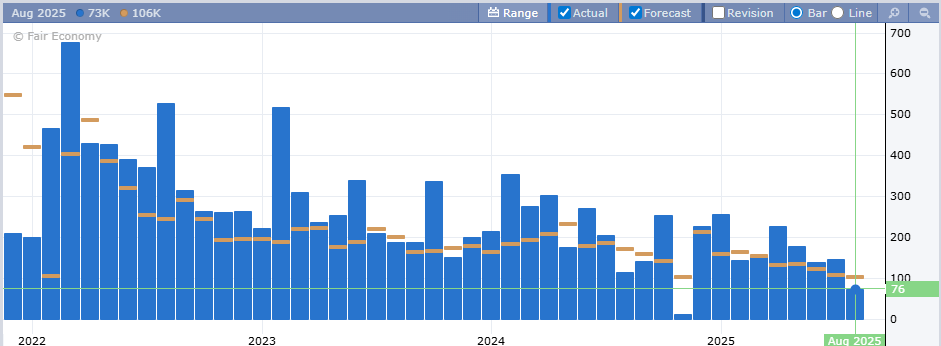

Today, the latest U.S. non-farm payrolls report was released, showing 73,000 new jobs, well below the forecast of 106,000, triggering concern in the markets. While employment has remained relatively stable, this figure reinforces the downward trend in the labor market that has intensified in 2025, possibly signaling a gradual economic slowdown.

Source: ForexFactory

In this new employment scenario, the strength of the U.S. dollar is being challenged, as the market perceives weakening confidence in the U.S. economy. Additionally, labor market performance is a key driver of the Federal Reserve’s policy, so this decline could mean lower inflationary pressure and create space for the Fed to cut interest rates earlier than expected.

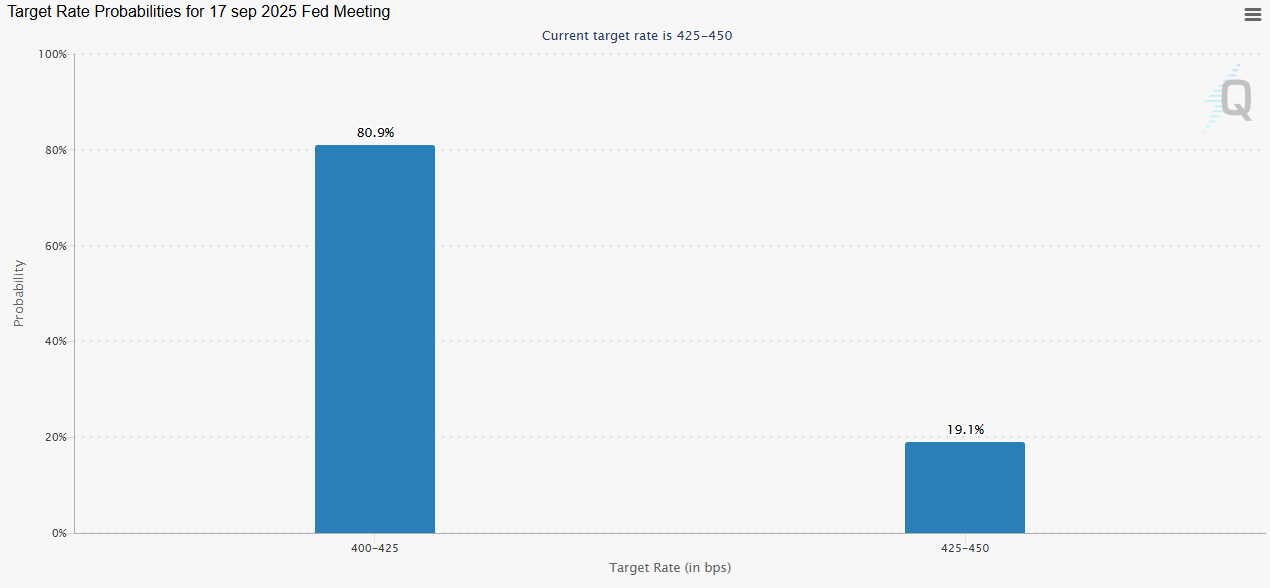

According to CME Group, there is now an 80.9% probability that the Fed will cut rates at its next September 17 meeting, from 4.5% to 4.25%, reinforcing expectations of a more dovish stance.

Source: CMEGroup

This new outlook opens the door for the Fed to begin a rate-cutting cycle sooner, potentially reducing the attractiveness of dollar-denominated assets, particularly fixed income. As a result, we may see weaker demand for the U.S. dollar, which would benefit the euro in the short term, supporting the bullish momentum in EUR/USD as this divergence persists.

What About the Trade War?

The deadline for trade negotiations with the White House has arrived. While some countries have reached agreements to avoid steep tariffs, others are now facing significant rates. Brazil, for instance, will face tariffs of 50%, and Canada will face 35%, although some strategic partners have secured reduced tariffs at 15%.

What’s most concerning is that these new tariffs signal a new phase in global trade, with the U.S. applying widespread measures to goods from around the world. Beyond the percentages, markets are worried that import costs will rise and many countries may retaliate with reciprocal tariffs, further increasing global economic uncertainty.

In this context, the euro is beginning to appear as a more stable alternative, especially when compared to a U.S. dollar weighed down by its own internal pressures. The perception that the European economy might better weather this new trade environment has helped sustain confidence in the euro in the short term.

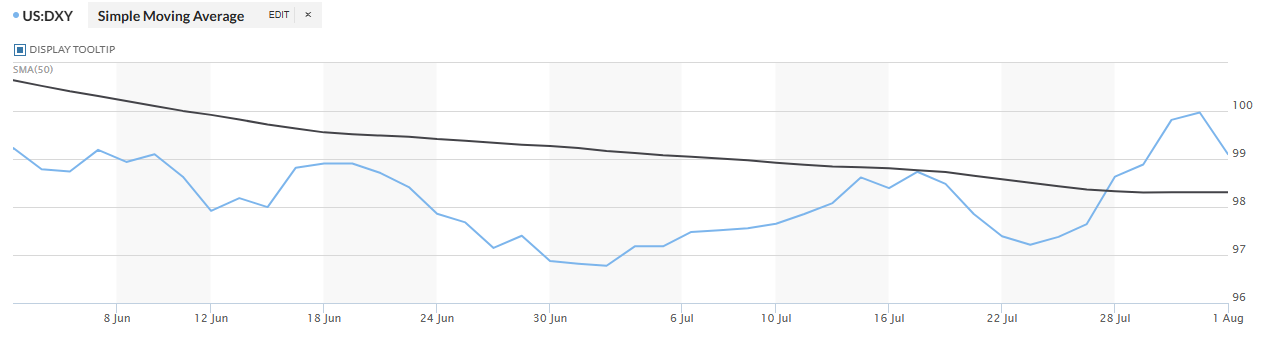

In fact, the DXY index, which tracks the dollar against a basket of currencies, has fallen from 100 to 99, confirming that the dollar is losing ground to other currencies.

Source: MarketWatch

If this new trade war continues to raise doubts about global growth and its potential impact on the U.S. in the coming months, the dollar is likely to lose relative appeal, while the euro could strengthen as a more resilient currency, increasing bullish pressure on EUR/USD in the near term.

EUR/USD Technical Outlook

Source: StoneX, Tradingview

- Strong Bullish Move: Although the euro had shown signs of weakness in previous weeks, today’s session has reignited a clear bullish bias. At present, there are no consistent signals suggesting the pair is about to enter a downtrend. The recent rally has helped halt the correction that EUR/USD had been undergoing, and if buying pressure holds, the pair could resume a sustained uptrend, despite recent pullbacks.

- RSI: The RSI line has stopped its decline and shows solid recovery, approaching the neutral 50 level. If a bullish crossover occurs at this level, buying momentum may strengthen, reinforcing the pair’s bullish structure.

- TRIX: The TRIX indicator has remained above the zero line, indicating that long-term moving average strength remains positive. If the TRIX continues to recover, it could anticipate renewed buying momentum in the sessions ahead.

Key Levels:

- 1.18196 – Major Resistance: This level marks the high of the year and is the most critical short-term resistance. A strong breakout above this level would reactivate the bullish bias, pushing the pair into a more sustained uptrend.

- 1.16286 – Nearby Resistance: This level aligns with the 50-period simple moving average. A move above this barrier would confirm a dominant bullish bias, at least in the short term.

- 1.12748 – Key Support: This key level has not been tested since May. A break below it would challenge the current trend and could signal a more defined bearish structure.

Written by Julian Pineda, CFA – Market Analyst

Follow him on: @julianpineda25