DXY, EUR/USD, GBP/USD, USD/CAD, Gold, Stocks Weekly Technical Outlook

August 4, 2025 19:26Weekly Technical Trade Levels on USD Majors, Commodities & Stocks

- Technical trade setups we are tracking into the weekly open

- Next Weekly Strategy Webinar: Monday, August 11 at 8:30am EST

- Review the latest Video Updates or Stream Live to my YouTube playlist.

In this webinar we take an in-depth look at the technical trade levels for the US Dollar (DXY), Euro (EUR/USD), British Pound (GBP/USD), Australian Dollar (AUD/USD), Canadian Dollar (USD/CAD), Japanese Yen (USD/JPY), Swiss Franc (USD/CHF), Gold (XAU/USD), Crude Oil (WTI), and Equity Indices. These are the levels that matter on the technical charts into the weekly open.

Euro Price Chart – EUR/USD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; EUR/USD on TradingView

Euro rebounded off downtrend support last week with the rally extending 1.8% off the monthly low. The focus is on this recovery with resistance objectives eyed at the 2016 high at 1.1616 and the 61.8% retracement of the July sell-off at 1.1662– rallies would need to be limited to this threshold IF price is heading lower on this stretch. A break / close below the monthly open / 23.6% retracement of the yearly range at 1.1415/40 is needed to mark downtrend resumption with subsequent support objective seen at 1.1347 and the 2023 high at 1.1275. Review my latest EUR/USD Technical Forecast for a closer look at the longer-term Euro trade levels.

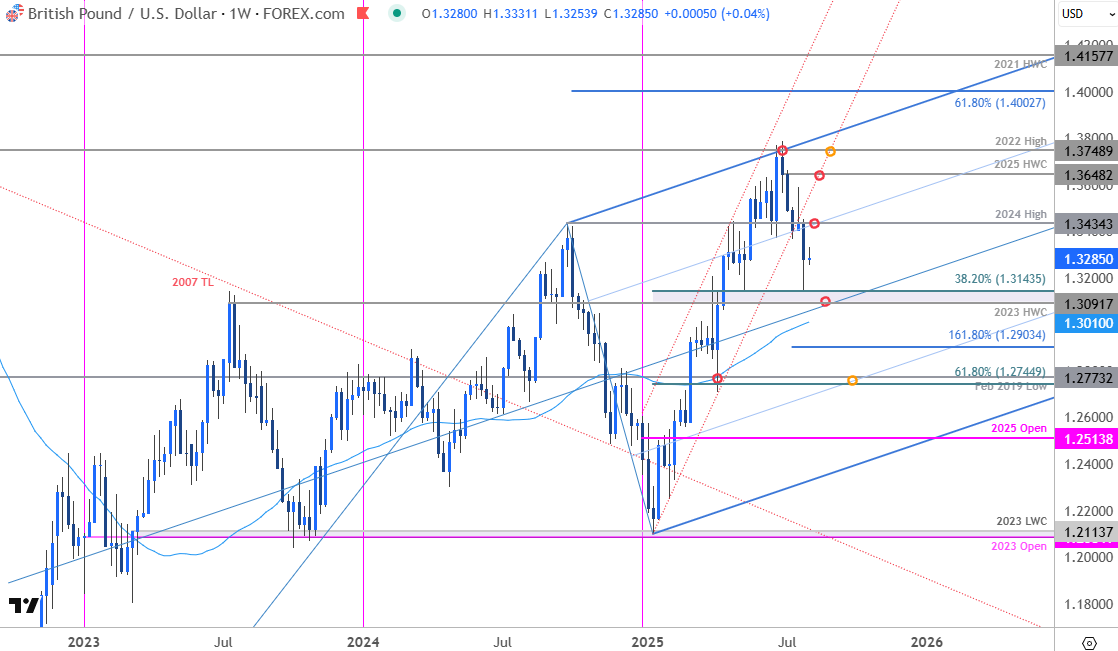

British Pound Price Chart – GBP/USD Weekly

Chart Prepared by Michael Boutros, Sr. Technical Strategist; GBP/USD on TradingView

Sterling broke below the yearly uptrend last week with the decline rebounding off the 2023 high-week close (HWC) / 38.2% retracement of the yearly range at 1.33092-1.3143. Initial resistance now back at the 2024 high at 1.3434 with a breach above the 2025 HWC at 1.3648 needed to mark resumption of the broader uptrend. A close below the median-line / 52-week moving average would be needed to suggest a more significant correction is underway towards the 1.618%extension at 1.2903 and 1.2745/73. Review my latest British Pound Short-term Outlook for a closer look at the near-term GBP/USD technical trade levels.

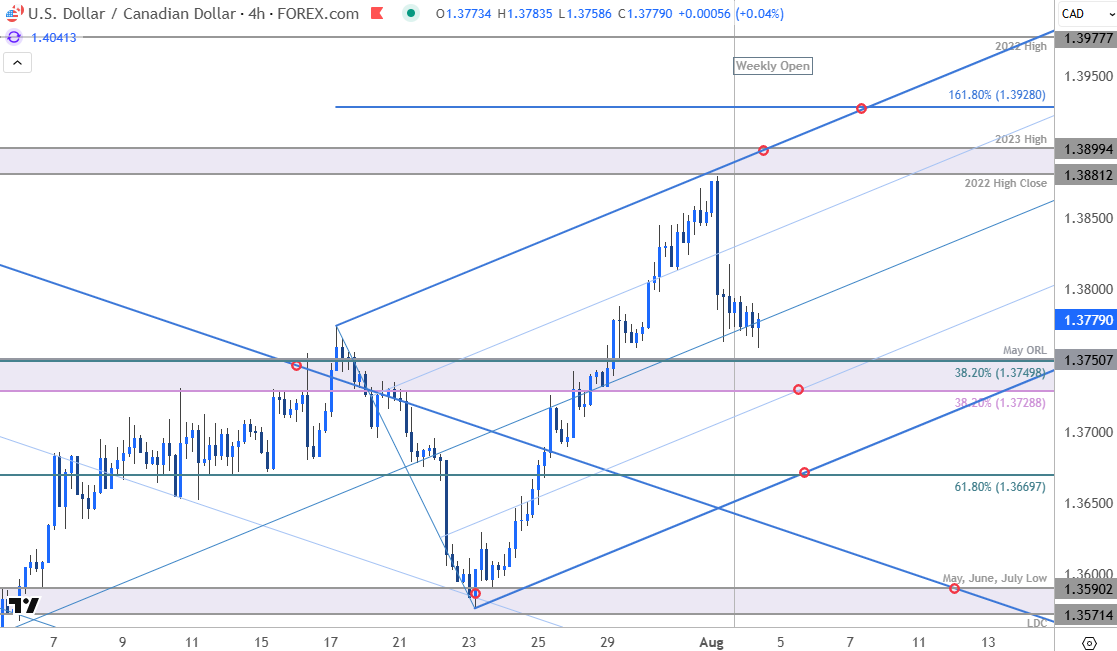

Canadian Dollar Price Chart – USD/CAD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; USD/CAD on TradingView

USD/CAD turned off uptrend resistance on Friday with the post-NFP sell-off now approaching confluent Fibonacci support at 1.3729/50– looking for possible infection off this zone in the days ahead. Bullish invalidation set to the 61.8% retracement at 1.3670. Resistance eyed at the 2022 high-close / 2023 high at 1.3881/99– a breach / close above this level would mark resumption of the July uptrend towards subsequent objectives at the 1.618% ext at 1.3928 and the 2022 high at 1.3978. Review my latest USD/CAD Short-term Outlook for a closer look at the near-term Canadian Dollar technical trade levels.

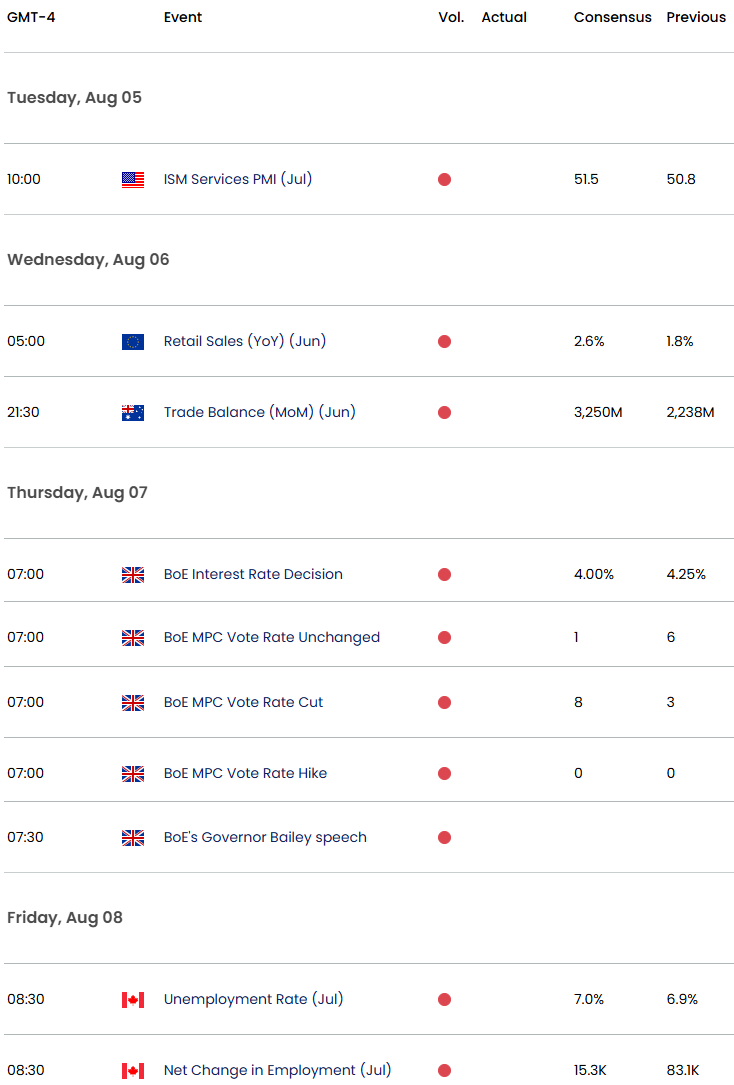

Economic Calendar – Key USD Data Releases

Economic Calendar – latest economic developments and upcoming event risk.

— Written by Michael Boutros, Sr Technical Strategist

Follow Michael on X @MBForex