EURUSD, Gold Forecast: FOMC Bets Lift Markets to Records

September 15, 2025 11:03Key Events in Focus:

• Growing expectations for Fed rate cuts and uncertainty around the FOMC outlook are driving risk assets — from currencies to indices to precious metals — to historical records.

• Political instability within the U.S., particularly tensions between Congress and the Fed, is keeping demand for safe havens elevated and pressuring the dollar ahead of the FOMC meeting.

• Gold eyes the $3,700 mark, while EUR/USD targets 1.18.

Countdown to the FOMC

With just one day remaining until the FOMC decision, markets expect the Fed to place rate cuts on the table to cushion the impact of labor market weakness — especially following the recent downward revision to the NFP data from 75,000 towards 22,000.

The VIX appears to be rebounding, trading above 15.60 after bouncing off Monday’s low of 14.40, signaling a potential shift in volatility sentiment.

Source: Tradingview

Indices & Dollar Majors Reacting to Dovish Momentum

Amid mounting macro pressures, expectations for a dovish outlook is pushing U.S. indices to new records:

• Nasdaq above 24,400

• Dow above 45,800

• S&P 500 above 6,600

At the same time, dollar pairs are pulling back, with major currencies like:

• EUR/USD trading above 1.1780

• GBP/USD above 1.3630

• DXY slipping below 97.00

Currently, the base case priced in by markets is a 25 bps cut, but the market reaction tomorrow will likely depend on the tone of the statement. A meeting that simply matches expectations may prompt a pullback, but a more dovish-than-expected tone could sustain the rally in risk assets.

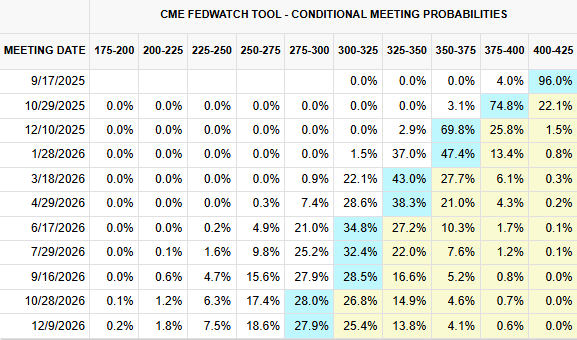

Source: CME Fed Watch Tool

• September meeting: Over 96% chance of a 25 bps cut

• Q4 outlook: Markets lean toward a cumulative 75 bps of cuts

However, the pace of implementation and forward guidance will be key in shaping market reaction.

Eurozone Caution

While the U.S. narrative dominates, the Eurozone is also navigating its own political turbulence, particularly with spiraling instability in France, which has added to haven flows. So far, EUR/USD has been primarily reacting to DXY moves, rather than euro-specific catalysts.

It’s worth noting that downside in DXY may be limited, with the broader price structure holding above a 17-year support level and long-term channel extending from 2008.

DXY Monthly Time Frame – Log Scale

Source: Tradingview

Analyzing the EURUSD and Gold Charts:

EURUSD Forecast: Daily Time Frame – Log Scale

Source: Tradingview

The EUR/USD has been unfolding an inverted head and shoulders pattern on the daily time frame (with the inverse formation seen on the DXY). The pair is currently trading beyond the neckline and the 1.1780 resistance, which reinforces a bullish tone on the chart — with upside potential first toward the 1.1830 record high, followed by the 1.20 and 1.22 marks, aligning with the full target of the head and shoulders structure.

From the downside, if the pattern fails and price action falls back below 1.1780, the zones I’ll be watching are 1.1730 and 1.1700, respectively, before confirming a deeper breakdown below the neckline of the formation.

Gold Forecast: Daily Time Frame – Log Scale

Source: Tradingview

Haven demand continues to support gold’s breakout from its five-month consolidation, with bullish momentum building toward the 3730–3800 zone — a key target range before any potential extension toward the $4,000 mark. Price action is currently holding above $3,690, with market focus centered on upcoming resistance levels near $3,700, $3,730, and $3,820.

To the downside, a break below $3,670 could trigger a corrective move toward $3,620, and if selling pressure accelerates, a deeper retracement toward $3,570 may unfold before buyers step back in for another attempt at continuation.

Written by Razan Hilal, CMT

Follow on X: @Rh_waves