EURUSD Tests 1.17 as DXY Dips to 98 — Breakout or Range?

August 7, 2025 14:52Key Events:

- Reciprocal tariffs have commenced, with steeper tariffs under negotiation

- DXY holds above the 98 support ahead of the U.S. market open

- EURUSD remains below the 1.17 resistance ahead of the U.S. market open

With Nasdaq back near record highs at 23,500 and Bitcoin trading above 116,000, risk appetite appears to be re-emerging. However, gold prices are still hovering just below the 3,400 mark.

As for currencies, the DXY has dropped toward the 0.618 Fibonacci retracement of the broader rally from 96 to 100. EURUSD, in turn, pulled back slightly from the 1.1680–1.17 resistance zone.

Trump’s tariffs took effect at midnight, targeting over 60 countries including the EU. More aggressive tariffs have been imposed on countries such as India, the EU, Taiwan, Japan, and South Korea, aiming to reduce the U.S. budget deficit and support domestic manufacturing. In connection with Russian oil imports, both India and China may face tariffs exceeding 40% by the end of August if they continue their imports. This may shift focus toward potential bloc retaliation against the U.S., particularly through BRICS strategic moves to reduce reliance on U.S. markets.

Uncertainty around gold’s bullish hold is justified, while Nasdaq’s surge requires confirmation above the 23,700 resistance. Similarly, EURUSD’s advance hinges on a confirmed breakout above 1.17, and DXY weakness must be validated with a clear break below the 98 level.

Technical Analysis: Quantifying Uncertainties

DXY Outlook: Daily Time Frame – Log Scale

Source: Tradingview

Beyond the bearish headlines, the DXY has retraced to the 0.618 Fibonacci level from the three-legged rebound between 96 and 100.20, suggesting a possible hold above 98 that could trigger a recovery toward 99.45 and 100.20. If a clear breakout above 100.20 occurs, a stronger uptrend may unfold targeting 101.70, 103.00, and 105.00.

On the downside, a confirmed close below 98 may lead to extended losses toward 97 and 96. A steeper decline toward 94 and 89 is also possible, likely strengthening EURUSD and GBPUSD toward their 2021 peaks.

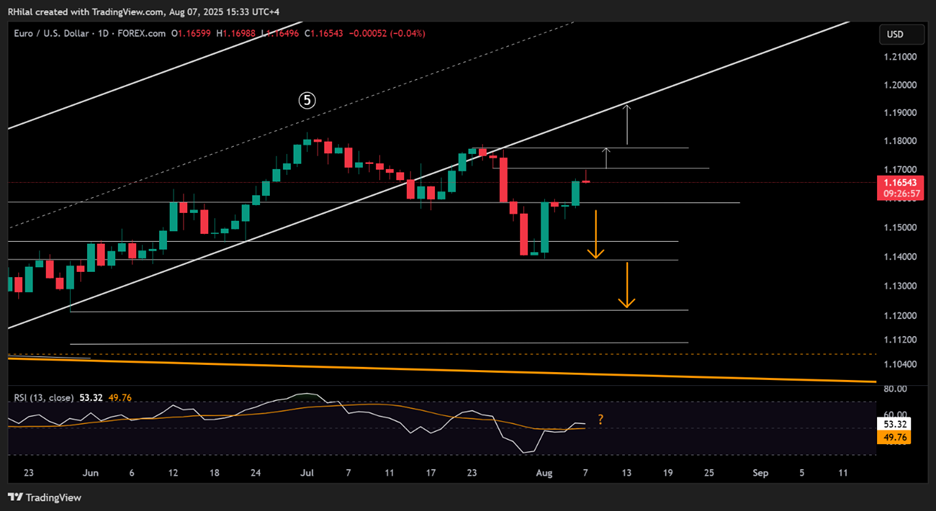

EURUSD Outlook: Daily Time Frame – Log Scale

Source: Tradingview

EURUSD surged toward the 1.17 resistance amid dollar weakness, with a daily RSI breakout above the 50-neutral level supporting bullish momentum. For a sustained bullish forecast, I’d like to see a clean hold above 1.17 and 1.18, which could extend gains toward 1.20 and 1.23 — aligning with the 2021 highs.

On the downside, if the pair prepares for another dip, a clean hold below 1.16 may extend losses toward 1.1520 and 1.1450, with the potential for a deeper drop toward 1.12 and 1.11.

Written by Razan Hilal, CMT

Follow on X: @Rh_waves