Gold Analysis: XAU/USD Attempts to Reach $3,400 per Ounce

August 5, 2025 22:15Gold has posted three consecutive bullish sessions, gaining over 3% in the short term and maintaining a strong buying bias. This upward momentum has been supported by a decline in market confidence and a possible shift in the Federal Reserve’s outlook, which has weakened demand for U.S. Treasuries, one of gold’s main competitors as a safe-haven asset. If this environment persists, buying pressure on the metal may continue to build in the coming sessions.

A New Fed Outlook?

Last week’s U.S. Non-Farm Payrolls (NFP) data surprised markets, showing only 73,000 new jobs versus the 106,000 expected. This result raised economic concerns, suggesting that high interest rates are starting to weigh on growth, while softening labor figures ease fears of persistent inflation. In theory, this opens the door for the Fed to begin its first rate-cutting cycle in 2025.

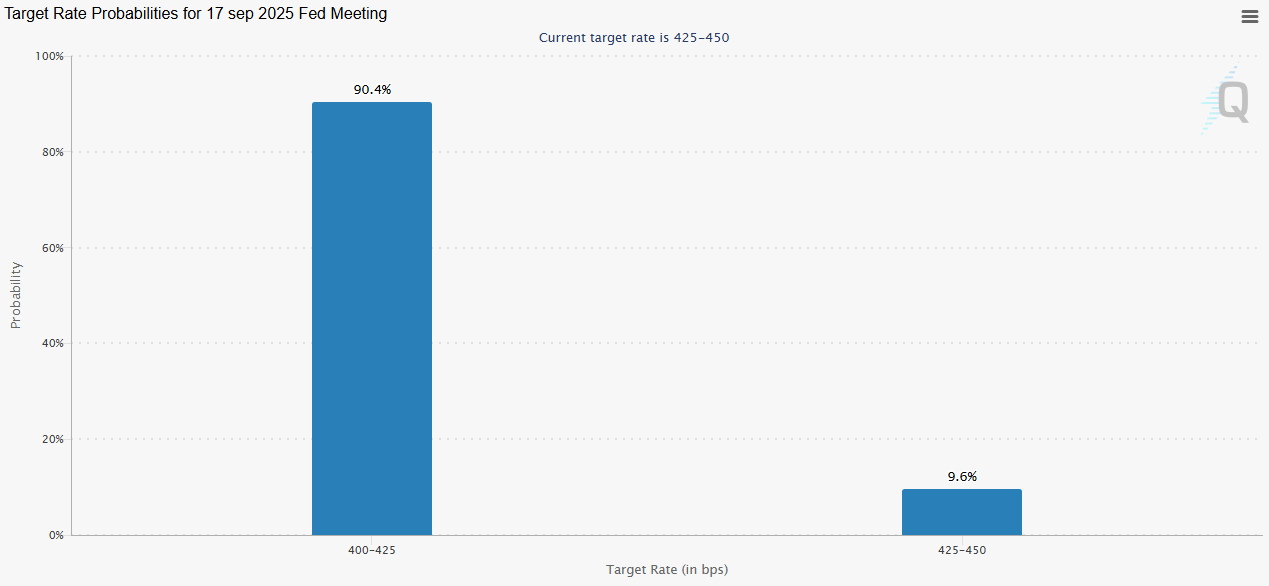

In fact, CME Group data shows a 90.4% probability that the Fed will cut rates to 4.25% at its next meeting on September 17, down from the current 4.5%.

Source: CME Group

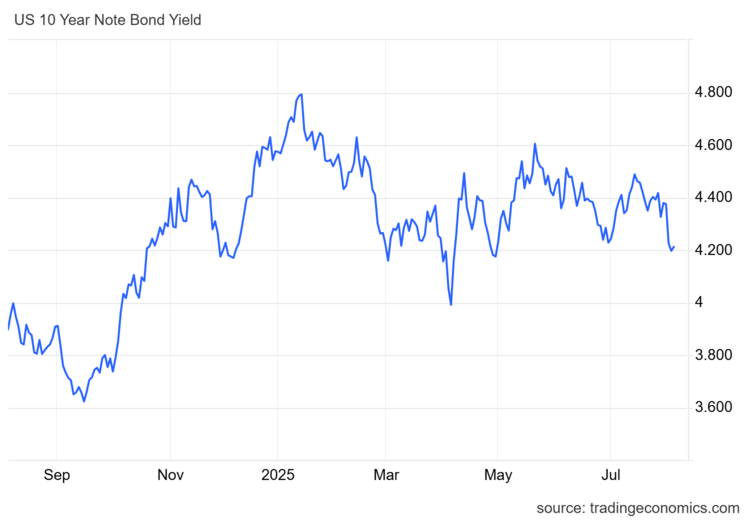

This outlook has already begun affecting the 10-year U.S. Treasury yield, one of the world’s safest assets and a direct competitor to gold. Yields have dropped to 4.2%, a level not seen since April of this year.

Source: TradingEconomics

With a potentially more dovish Fed, Treasuries may lose appeal as an investment, impacting foreign demand for U.S. dollars. In this scenario, gold as an essential safe-haven asset and direct competitor to the dollar, could benefit. If both the dollar and bond markets remain weak, gold is likely to continue strengthening in the short term.

Market Sentiment

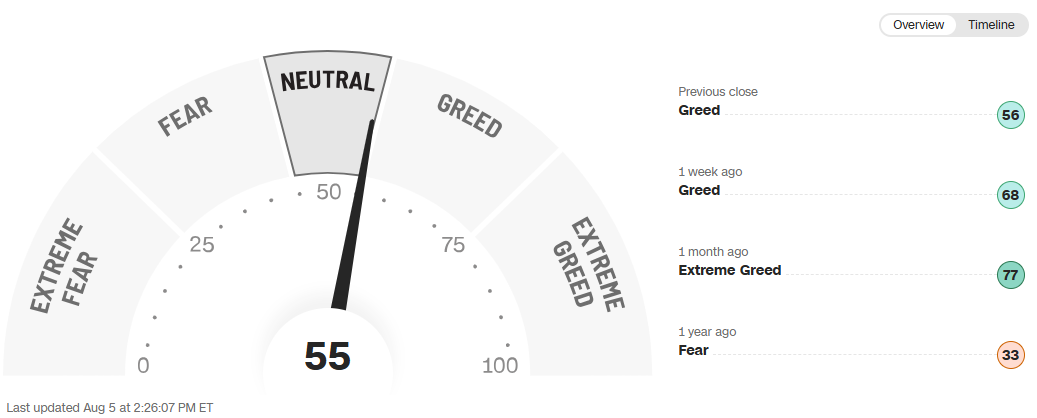

The CNN Fear & Greed Index currently sits at 55, entering neutral territory for the first time in weeks. This shift suggests a potential weakening in investor confidence, especially amid recent developments like the renewed trade war, which has once again cast doubt on the global economic outlook for this year.

Source: CNN

This sentiment shift indicates that risk perception is on the rise, which could increase demand for safe-haven assets like gold. If this risk-off environment persists, buying pressure on gold may continue to grow, reinforcing the bullish bias on XAU/USD in the short term.

Gold Technical Outlook

Source: StoneX, Tradingview

- Sideways Range Holds: Gold continues to trade within a lateral channel, bounded by $3,400 resistance and $3,200 support. In recent sessions, the price has again approached the upper boundary of the range, though without a decisive breakout. For now, this sideways structure remains the dominant technical pattern in the short term.

- RSI: The RSI line maintains an upward slope above the 50 level, indicating growing bullish momentum. If this trend continues, gold could revisit the resistance area near the top of the range.

- MACD: The MACD histogram also shows positive movement above the zero line, suggesting that average momentum from moving averages is turning upward. If this continues, buying pressure may strengthen further.

Key Levels to Watch:

- $3,400 – Major Resistance: This level marks recent highs and the top of the range. A sustained breakout above this zone could trigger a new bullish leg, resuming the upward trend that began earlier this year.

- $3,300 – Intermediate Barrier: A technical midpoint that aligns with the 50-period moving average. It may act as a pivot level to absorb potential pullbacks, especially if price fails to break through $3,400.

- $3,200 – Critical Support: This level represents the base of the current range and recent lows. A breakdown here could put the current structure at risk and signal a clearer bearish trend in the near term.

Written by Julian Pineda, CFA – Market Analyst

Follow him on: @julianpineda25