Key Events to Watch:

- EURUSD hits daily oversold levels at the 1.1390 support

- GBPUSD hits daily oversold levels at the 1.3200 support

- DXY hits 100 resistance following positive Advance GDP and hawkish FOMC tones. Core PCE today, and US NFP and ISM Manufacturing PMI on Friday are next to test the week’s positive rebound.

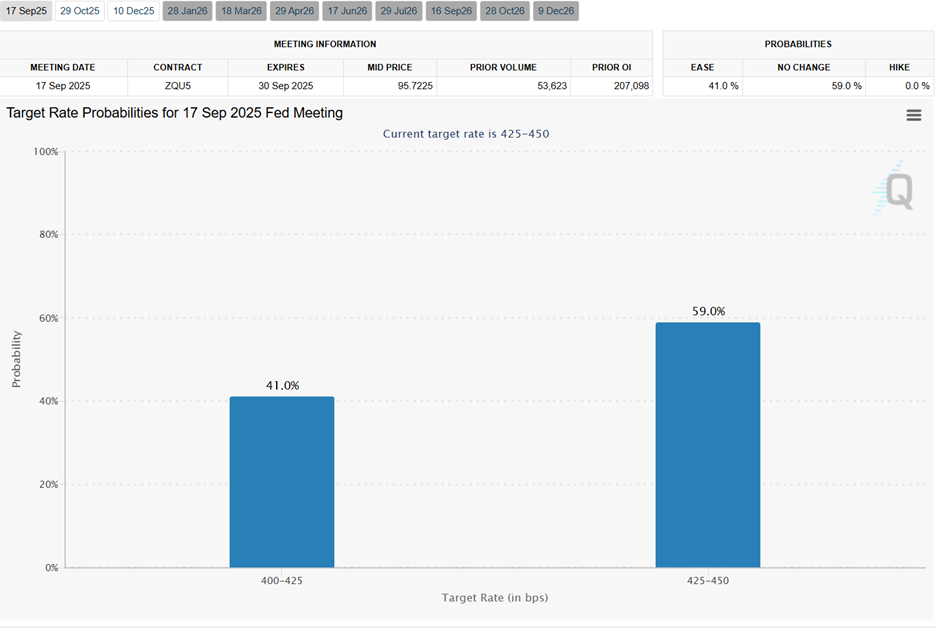

As Jerome Powell reinforced a hawkish tone, citing persistent inflation concerns—more than previously expected—interest rate cut expectations dampened heading into September. Rate hold expectations now stand near 60%, while October’s 25 bps rate cut expectations are around 48%, according to the CME Fed Watch Tool.

CME Fed Watch Tool: September Fed Rate Expectations

Source: (CME Fed Watch Tool)

DXY Analysis: 3-Day Time Frame – Log Scale

Source: Tradingview

Following a sharp market shift and a surprising rise in Advance GDP from -0.5% to 3%, the DXY advanced toward the 100.20 resistance mark. The index now stands between a potential correction or a trend extension, depending on several technical signals: the RSI breakout above the 50 zone on the 3-day chart, a confirmed breakout above 100.20 resistance, and upcoming economic data including the US Core PCE (today), US NFP, and ISM Manufacturing PMI (Friday).

EURUSD Forecast: Daily Time Frame – Log Scale

Source: Tradingview

The pullback in EURUSD aligned with the 0.272 Fibonacci retracement level of the 2025 uptrend between 1.017 and 1.1830, holding at the 1.1390 support. This lifts rebound probabilities back above the 1.15 mark, should a clean hold emerge above 1.1450. The pair may then climb toward 1.1550 and 1.1780, respectively.

From the downside, if the 1.1390 support fails, the trend may extend into a deeper retracement toward the 0.382 Fibonacci level at 1.12, followed by 1.11.

GBPUSD Forecast: Daily Time Frame – Log Scale

Source: Tradingview

Unlike EURUSD, GBPUSD presents more downside risk. Its reversal pattern has formed a head and shoulders, extending the downside target toward 1.3140 and 1.2940. Should the pair recover above the pattern’s neckline or the 1.3330 zone, it may resume gains toward 1.3450, 1.36, and 1.38, respectively.

Written by Razan Hilal, CMT

Follow on X: @Rh_waves