Gold Price Forecast: XAU/USD Awaits Fed and NFP Volatility

July 27, 2025 20:09Gold Technical Forecast: XAU/USD Weekly Trade Levels

- Gold July range-breakout reverses at resistance, traders look to FOMC, PCE, NFP next week

- XAU/USD breakout of nine-week range imminent into monthly cross

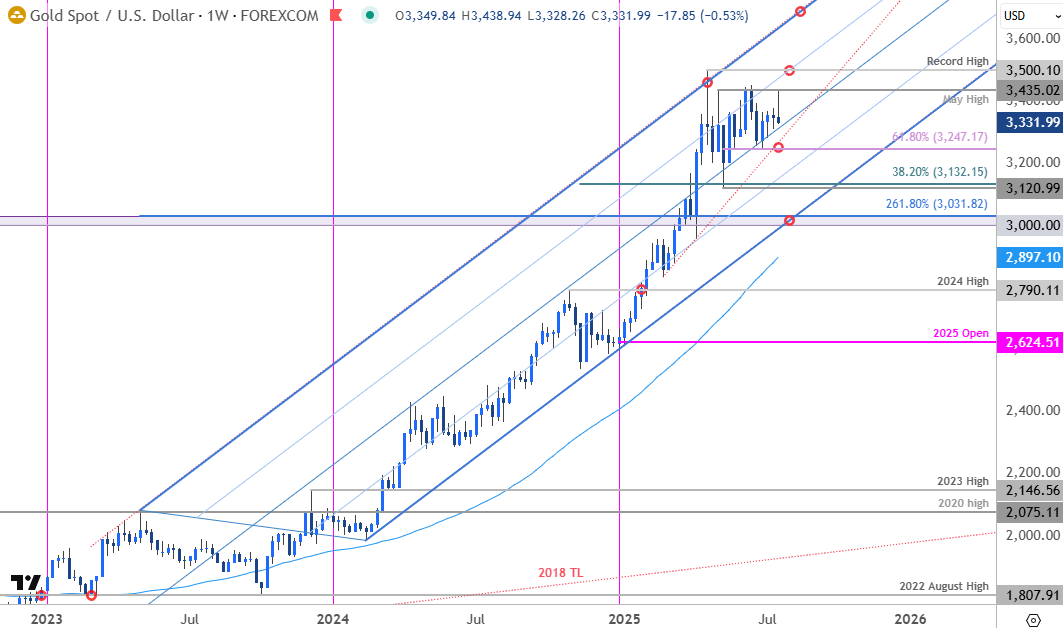

- Resistance 3432/35, 3500(key), 3650s– Support 3247, 3121/32, 3000/31 (key)

Gold is poised to mark a third consecutive daily loss on Friday with XAU/USD erasing a three-day rally into resistance. The reversal keeps gold prices within a nine-week range with the bears now threatening another test of the yearly uptrend ahead of major event risk. Battle lines drawn on the XAU/USD weekly technical chart into the close of July.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this gold setup and more. Join live on Monday’s at 8:30am EST.

Gold Price Chart – XAU/USD Weekly

Chart Prepared by Michael Boutros, Sr. Technical Strategist; XAU/USD on TradingView

Technical Outlook: In my last Gold Technical Forecast our focus was on a critical range in XAU/USD, just below uptrend resistance. We note that, “From a trading standpoint, the immediate focus is on a breakout of the 3247-3435 range for guidance. Losses should be limited to 3000 for the 2024 uptrend to remain viable with a close above 3500 still needed to fuel the next major leg of the advance.” Gold rallied nearly 5.9% off those lows with price briefly registering an intraday day high at 3439 this week before reversing sharply lower. XAU/USD has already plunged more than 3.2% from the weekly high with price poised to close the weekly candle down nearly 0.6%- risk for a larger set back here.

The immediate focus is on this week’s close with respect to the median-line (blue) with a break below threatening the lower bounds of the nine-week range at 3247– a region defined by the 61.8% retracement of the May advance, the June low, and the February trendline (red). A break / close below this threshold would suggest a more significant correction is underway within the multi-year uptrend. Subsequent support objective rests at the May low / 38.2% retracement of the November advance at 3121/32 with broader bullish invalidation unchanged at 3000/31– both zones of interest for possible downside exhaustion / price inflection IF reached.

Weekly resistance steady at the record high-close / May high at 3432/35 with a breach / weekly close above 3500 ultimately needed to mark uptrend resumption. Subsequent resistance eyed at the upper parallel, currently near ~3650s.

Bottom line: Gold was rejected at resistance again this week and the monthly opening-range reversal keeps the focus on a test of the yearly uptrend- watch today’s close with respect to the median-line. From at trading standpoint, the near-term threat remains lower while below the record high-day close at 3381 with a break / close below 3247 needed to fuel a larger correction within the multi-year uptrend.

Keep in mind we are heading major headline risk next week with the Federal Reserve interest rate decision, core personal consumption expenditures, and non-farm payrolls on tap into the August open. Stay nimble into the monthly cross and watch the weekly closes for guidance. Review my latest Gold Short-term Outlook for a closer look at the near-term XAU/USD technical trade levels.

Key US Economic Data Releases

Economic Calendar – latest economic developments and upcoming event risk.

Active Weekly Technical Charts

- Euro (EUR/USD)

- US Dollar Index (DXY)

- British Pound (GBP/USD)

- S&P 500, Nasdaq, Dow

- Crude Oil (WTI)

- Japanese Yen (USD/JPY)

- Australian Dollar (AUD/USD)

- Canadian Dollar (USD/CAD)

- Swiss Franc (USD/CHF)

— Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on X @MBForex