The Euro has recorded four consecutive sessions of gains, with the EUR/USD pair appreciating more than 1.5% during this period. However, following the latest European Central Bank (ECB) rate decision and recent developments in trade talks with the United States, the pair has started to show signs of neutrality. This trend could persist in the coming sessions, as the market digests new ECB projections and incorporates key updates on the trade conflict, which may continue to influence short-term price action.

ECB Decision Day Arrives

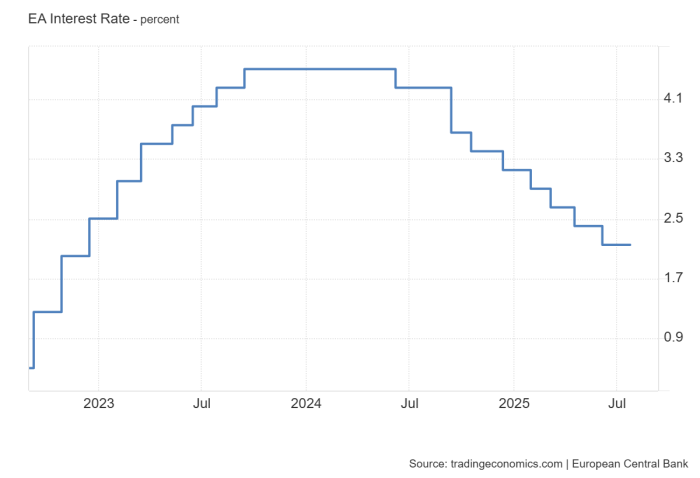

Today, the ECB kept its key interest rate at 2.15%, marking the first pause in its recent easing cycle, which had been ongoing since July 2024. The decision was seen as a shift in tone, with the central bank now adopting a more neutral stance on the eurozone’s economic outlook.

Source: Trading Economics

This policy shift carries weight. While European rates had been on the decline, the euro was becoming less attractive relative to other currencies, particularly the US dollar, which maintains a rate of 4.5%. The ECB’s pause may now help restore some appeal to euro-denominated assets, especially if rates remain stable over the coming months.

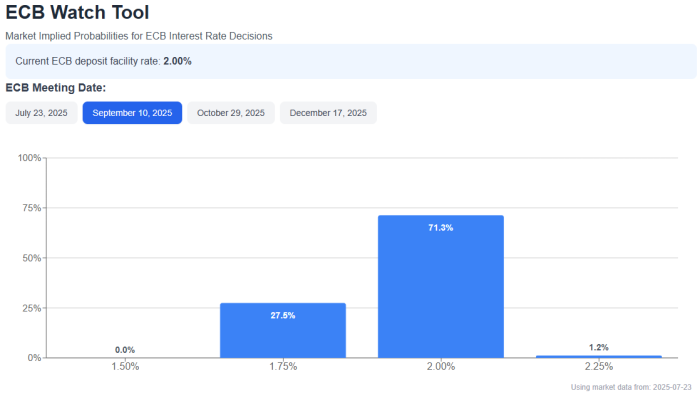

In fact, for the next policy meeting on September 10, market expectations point to a 71.3% probability that the ECB will leave both its deposit rate (2%) and refinancing rate (2.15%) unchanged, reinforcing the idea that this neutral stance could be extended.

Source: ECB Watch

If this stable outlook persists, fears of further cuts may ease, supporting demand for European fixed income assets. This would likely create bullish pressure on the euro, especially if the market believes the ECB has concluded its most aggressive easing phase.

What’s Next for the Trade Conflict?

The European Union remains one of the regions most exposed to potential new tariffs from the United States, and until recently, no concrete agreement had been reached. However, reports in recent days suggest a partial deal is being discussed, which would reduce the initially proposed 30% tariff to 15% on European exports to the US.

Although technical terms have yet to be finalized and no formal consensus has been reached, both parties have responded positively to this development. It could serve as a starting point for deeper negotiations in the coming weeks, with the aim of de-escalating the trade dispute.

Markets have welcomed this news as a positive driver for the euro. As the US dollar struggles to gain sustained strength, reduced trade tensions may help maintain investor confidence in the euro. If a partial agreement is finalized and confidence continues to improve, demand for the euro could stabilize, potentially contributing to renewed buying interest in EUR/USD in the near term.

EUR/USD Technical Outlook

Source: StoneX, Tradingview

- Narrow Sideways Range: Recent bullish momentum has brought EUR/USD back near yearly highs, but the market has begun to shift into a more neutral pattern. In the short term, price remains contained within a range between resistance at 1.18196 and support at 1.16379. Without a breakout above or below these levels, no clear long-term direction can be confirmed. Since price is hovering near highs, this could leave room for a potential short-term pullback.

- MACD: The MACD histogram continues to fluctuate around the zero line, indicating that no dominant momentum is currently driving the moving averages. This lack of directional strength suggests the market may remain in a lateral consolidation phase, at least in the short term.

- ADX: The ADX indicator presents a similar picture. It remains below the 20 level, reflecting low volatility and no prevailing trend. If this condition persists, EUR/USD is likely to remain within its current sideways channel.

Key levels:

- 1.18196 – Key Resistance: This level marks the year’s high and stands as the most important near-term barrier. A breakout above this area could revive the previous uptrend, triggering a fresh wave of bullish momentum.

- 1.16379 – Nearby Support: This zone defines the lower boundary of the current range and may act as a temporary floor during any upcoming pullbacks.

- 1.15000 – Psychological Support: Arguably the most important psychological level on the chart, this support acts as the last line of defense for the current bullish structure. A drop below this level could jeopardize the broader uptrend and set the stage for a more sustained downward move.

Written by Julian Pineda, CFA – Market Analyst

Follow him at: @julianpineda25