EUR/USD Rally Unravels Ahead of Monthly High

July 27, 2025 19:30Euro Forecast: EUR/USD

EUR/USD snaps the recent series of higher highs and lows as it gives back the advance following the European Central Bank (ECB) meeting, and the exchange rate may consolidate over the coming days as it pulls back ahead of the monthly high (1.1830).

EUR/USD Rally Unravels Ahead of Monthly High

EUR/USD continues to pull back from the weekly high (1.1789) even though the ECB keeps Euro Area interest rates on hold for the first time this year, and the exchange rate may no longer respond to the positive slope in the 50-Day SMA (1.557) should it struggle to retain the rebound from the monthly low (1.1557).

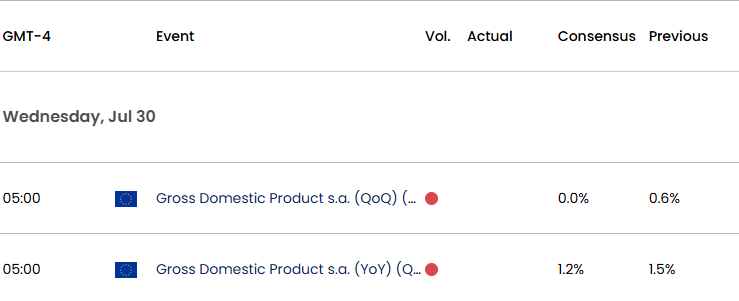

Euro Economic Calendar

At the same time, the update to the Euro Area’s Gross Domestic Product (GDP) report may sway EUR/USD as the economy is expected to hold flat in the second quarter after expanding 0.6% during the first three-months of 2025.

Signs of a slowing economy may put pressure on the Governing Council to implement lower interest rates as President Christine Lagarde and Co. pledge to ‘follow a data-dependent and meeting-by-meeting approach,’ and speculation for another ECB rate-cut in 2025 may keep EUR/USD under pressure over the remainder of the month.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

However, a better-than-expected GDP report may keep the ECB on the sidelines as ‘growth is developing mostly in line with, if not a little better than, our expectations,’ and a positive development may curb the recent weakness in EUR/USD as the central bank seems to be at the end of its rate-cutting cycle.

With that said, the failed attempt to test the monthly high (1.1830) may lead to a further pullback in EUR/USD, but the exchange rate may continue to track the positive slope in the 50-Day SMA (1.557) as it still holds above the moving average.

EUR/USD Chart – Daily

Chart Prepared by David Song, Senior Strategist; EUR/USD on TradingView

- EUR/USD pulls back ahead of the monthly high (1.1830) to snap the recent series of higher highs and lows, and lack of momentum to hold above the 1.1690 (78.6% Fibonacci extension) to 1.1750 (78.6% Fibonacci retracement) zone may push the exchange rate toward 1.1560 (100% Fibonacci extension).

- A breach below the monthly low (1.1557) opens up the 1.1390 (78/6% Fibonacci extension) to 1.1440 (61.8% Fibonacci extension) region, with the next area of interest coming in around the June low (1.1347).

- At the same time, the recent weakness in EUR/USD may turn out to be temporary should it continue to hold/close above the 1.1690 (78.6% Fibonacci extension) to 1.1750 (78.6% Fibonacci retracement) zone, and a move above the monthly high (1.1830) may lead to a test of the September 2021 high (1.1909).

Additional Market Outlooks

USD/CHF Bounces Back Ahead of Monthly Low

US Dollar Forecast: USD/JPY Struggles amid Failure to Test April High

AUD/USD Bounces Back Ahead of June Low to Register Fresh Yearly High

British Pound Forecast: GBP/USD Stages Three Day Rally

— Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong