DXY Rebound Threatens EURUSD, USDCAD in Volatile Market Week

July 29, 2025 11:41Key Events to Watch This Week:

- Leading US Economic Indicators: US Advance GDP and FOMC (Wednesday), US Core PCE (Thursday), US NFP (Friday), US ISM PMI (Friday), EUR Flash CPI (Friday)

- Central Bank Rate Decisions and Their Impact on Market Sentiment: Bank of Canada (Wednesday), Federal Reserve (Wednesday), and Bank of Japan (Thursday)

At the start of what might be the most event-packed economic week of the year, the US Dollar Index is posing a bullish rebound threat to the currency market. The dollar has pulled EURUSD below the 1.16 mark and pushed USDCAD above 1.3750, setting a reversal tone for the week despite the sheer weight of economic indicators and central bank decisions impacting market sentiment and rate cut expectations for the remainder of the year.

Positive developments in trade talks between the US and the EU contributed to broader stock market appetite. Meanwhile, the dollar’s recovery across the currency board is still challenged by the critical 100 resistance level, which may be tested amid this week’s dense lineup of events.

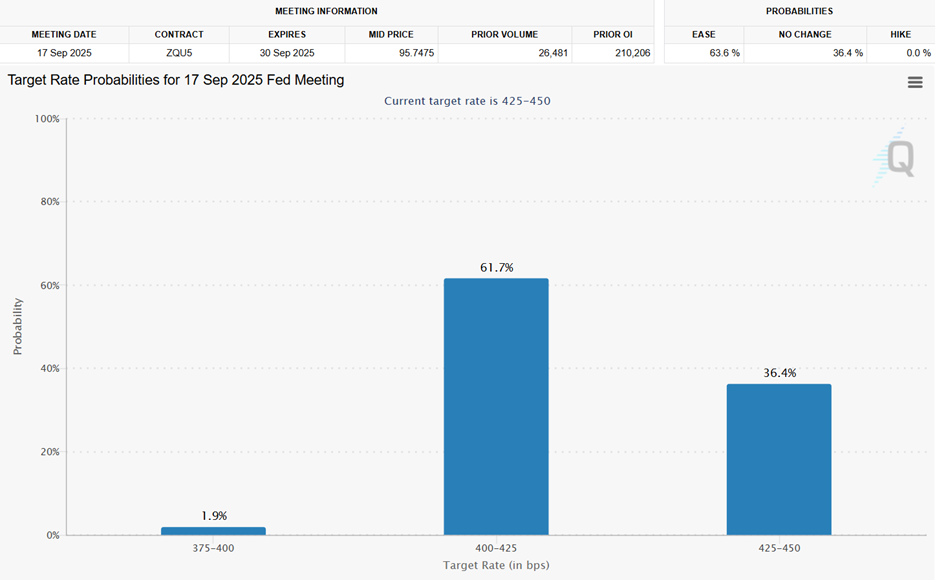

CME Fed Watch Tool: September Meeting Expectations

Source: CME Fed Watch Tool

Markets are expecting the Fed to hold rates at 4.5% during tomorrow’s meeting, with a projected 25-bps cut in September, according to the CME FedWatch Tool. These expectations are driving gains in equity indices ahead of tech earnings volatility. However, the upcoming FOMC decision may either reinforce or shift the current narrative.

Markets also expect the Bank of Canada to hold rates at 2.75%, leaving any major policy-driven moves and expectations dependent on the tone of the press conference.

Technical Analysis: Quantifying Uncertainty

EURUSD Forecast: 3-Day Time Frame – Log Scale

Source: TradingView

Following the DXY’s significant rebound off a 17-year trendline, the EURUSD has broken below a trendline that connected all consecutive lows of 2025. This opens the door to further bearish risks, with key support levels now in sight. If the pair closes cleanly below 1.1440 and 1.1380, downside extensions could reach 1.12 and 1.11, respectively.

On the upside, a close back above the 2025 trendline and the 1.18 mark could reinstate bullish momentum, potentially lifting the pair toward the 2021 highs between 1.20 and 1.23.

USDCAD Forecast: 3-Day Time Frame – Log Scale

Source: TradingView

Aligned with the DXY holding above the 96 support and approaching the 100-resistance, the USDCAD is maintaining a rebound above the 1.3540 level. It has maintained a hold beyond the boundaries of a contracting downtrend across 2025 and is aiming for the 1.38 resistance to confirm a steeper bullish breakout.

A sustained move above 1.38, which connects lower highs from June and July, while the RSI holds below the 50 neutral line, could extend gains toward the 1.40 level.

From the downside, should the breakout above 1.38 fail, the pair may remain trapped within the consolidation range extending from June, with initial support seen at 1.3580.

Written by Razan Hilal, CMT

Follow on X: @Rh_waves