DXY, EUR/USD, GBP/USD, USD/CAD, Gold, SPX500 Weekly Technical Outlook

June 30, 2025 18:27Weekly Technical Trade Levels on USD Majors, Commodities & Stocks

- Technical trade setups we are tracking into the weekly open / shortened holiday week

- Next Weekly Strategy Webinar: Monday, July 7 at 8:30am EST

- Review the latest Video Updates or Stream Live to my YouTube playlist.

In this webinar we take an in-depth look at the technical trade levels for the US Dollar (DXY), Euro (EUR/USD), British Pound (GBP/USD), Australian Dollar (AUD/USD), Canadian Dollar (USD/CAD), Japanese Yen (USD/JPY), Swiss Franc (USD/CHF), Gold (XAU/USD), Crude Oil (WTI), and Bitcoin (BTC/USD). These are the levels that matter on the technical charts into the weekly open as markets weigh the impact of US strikes on Iran.

British Pound Price Chart – GBP/USD Weekly

Chart Prepared by Michael Boutros, Sr. Technical Strategist; GBP/USD on TradingView

Sterling marked an outside weekly-reversal through slope resistance last week with the rally trading just below resistance into the close of the month at the 2022 swing high at 1.3749. Look for support at the June high at 1.3633 IF price is heading higher on this stretch with a breach / close higher exposing the 61.8% extension of the 2022 advance at 1.4003. Weekly support rests with the 78.6% retracement at 1.3414 with media-term bullish invalidation now raised to the April high-week close (HWC) at 1.3270.

Gold Price Chart – XAU/USD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; XAU/USD on TradingView

Gold is threatening a break of the yearly uptrend with Friday’s decline clearing the monthly range low. The focus into the start of the month is on technical support at the 5/29 swing low / May low-day close (LDC) 3240/45. A break / close below this threshold would be needed to suggest a more significant correction is underway towards the 38.2% retracement of the November rally at 3132 and the 100% extension of the April decline at 3072– both areas of interest for possible downside exhaustion / price inflection IF reached. Resistance now at 3355/80 with a breach above the Record high-close at 3431 needed to mark resumption of the broader uptrend.

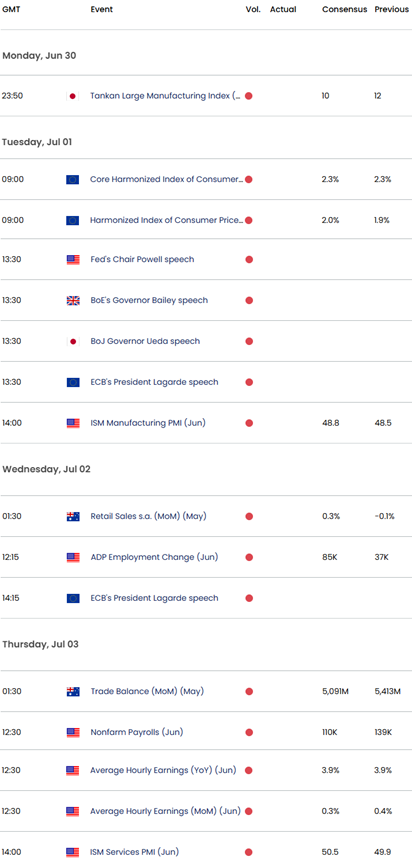

Economic Calendar – Key USD Data Releases

Economic Calendar – latest economic developments and upcoming event risk.

— Written by Michael Boutros, Sr Technical Strategist

Follow Michael on X @MBForex